Bank deposit products and services provided by PNC Bank, National Association. Member FDIC

Reviewing Your Business Line of Credit Statement

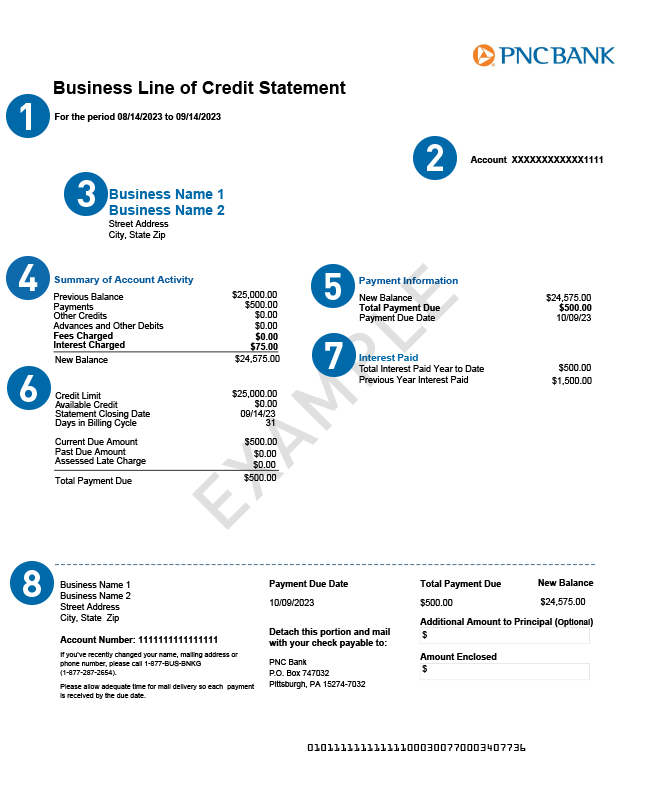

Billing Cycle:

The beginning and ending date of the billing cycle for this statement.

Account Number:

The last four digits of your account number that identifies your Business Line of Credit with PNC

Customer Name:

Customer name and mailing address.

Summary of Account Activity:

Detailed explanation of the account activity, including previous balance, any payments made, any fees, if applicable, the interest charged during this cycle and new balance.

Payment Information:

The Total Payment amount due and date by which you need to make your Business Line of Credit payment.

Credit Limit & Amount Due:

Your overall credit limit credit limit, billing cycle information, and an explanation of your total payment due.

Interest Paid:

Total interest paid year to date and interest paid in the previous year.

Billing Statement Payment Information:

This section can be used as a payment slip, or will inform you that the payment will be automatically deducted if your line is set up for automatic payments.

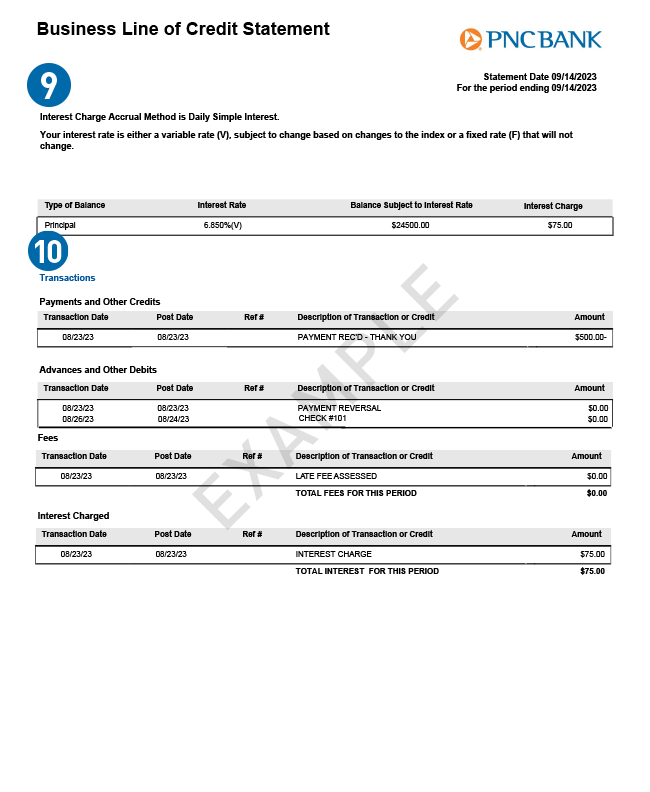

Interest Charge Accrual Method:

Information regarding your interest charge during the billing cycle and whether the account is a "fixed" or "variable" rate.

Transactions:

A quick review of transactions that have taken place since the last billing statement.