Enrollment in any combination of additional non-DDA Payment Service Solutions (including Treasury Management and Merchant Services) will result in service fees. Subscription, transactions and user fees may apply. Certain additional non-DDA services are billed 2 months in arrears. You may see two months of trailing fees after cancellation of these additional non-DDA services.

Treasury Management

& Fraud Mitigation

Cash flow is the lifeblood of your business. Make the most of it.

What is Treasury Management?

Harness the Strength of Our Cash Flow Solutions.

We know that there is no such thing as “one size fits all.” That’s where a cash flow conversation comes in for businesses under $5 million in revenue.

Let's learn more about your situation – how your business operates, where you want to take it, the opportunities and challenges you face, your aspirations and what drives you – to fulfill your everyday cash flow needs.

For businesses over $5 million in revenue

Treasury Management helps commercial businesses make the most of their cash flow.

Treasury Management Solutions

- Receivables

- Payables

- Online Tools

- Liquidity Management

Take control of incoming cash and make payments convenient for your customers, while mitigating risk.

Gain more control over your cash flow which can improve payment terms and reduce risks.

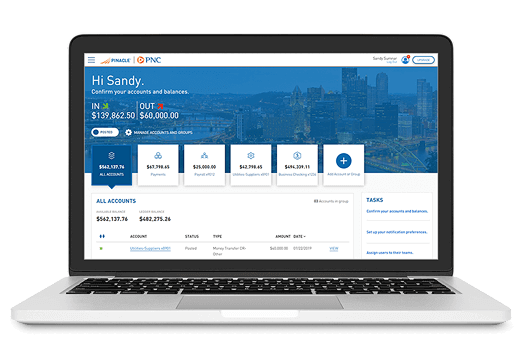

Gain insight and access anytime – it’s available when you want, where you want it.

With a variety of accounts, get competitive rates on a variety of short-term investment opportunities.

Fraud Mitigation Tools

Our comprehensive approach combines advanced technologies and security tools designed to help you identify and thwart attempts to compromise your financial accounts, including fraudulent checks and electronic transactions if presented for payment.

Help you protect your account from unauthorized activity, whether initiated electronically via ACH, or manually via paper check.

Stop Fraud in its Tracks

Mask and protect your information with UPIC.

PNC offers fraud protection tools for checks and electronic payments, enabling you to choose the detection tool that’s right for your business’.

Stop Fraud in its Tracks

Universal Payment Identification Code (UPIC) masks your checking account number so you can accept ACH credits without having to provide your PNC account number to the payment sender.

Insights

Manage Business Finances

Deposit Accounts for Manufacturers: Pay Suppliers Without Draining Cash

Use a business checking account to align payables with production timing, preserve liquidity, capture early-pay discounts, and strengthen supplier relationships.

3 min read

Manage Business Finances

From Cart to Cash: Reconciling Marketplace Payouts

Restore cash visibility in e-commerce with a deposit account, daily reconciliation, and integrated merchant reporting for faster closes and cleaner books.

3 min read

Manage Business Finances

The Increased Cost of Doing Business: 10 Ways To Save

Don't let rising costs squeeze your margins. These 10 practical banking and processing tweaks may boost cash flow, cut fees, and prevent costly mistakes.

2 min read

Contact Us

We're available to help.

Start Your Cash Flow Conversation Today

Share a few details with us and a PNC Treasury Management representative will contact you shortly.

If you have questions or would like additional information, please fill out this short form so we can get in touch with you. By completing this form, you are authorizing us to contact you (via email and/or phone) to answer your questions and provide information about our products and services.