1. 2022 GREENWICH ASSOCIATES - A DIVISION OF CRISIL (PART OF S&P GLOBAL)

Commercial Banking

Our boring banking philosophy can be explained in one word. Results.

Who We Serve

PNC’s Commercial Banking team serves businesses with annual revenues between $5 million and $50 million. If your company’s revenue is under $5 million, visit Business Banking.

As you drive the future of your company, what kind of bank will serve you best? Maybe it’s the bank that thinks like you do. That treats you the way you treat your customers.

That combines a deep and committed knowledge of your local conditions with the strength and innovation only a large bank can offer.

What We Offer

Our experienced Relationship Managers work with you by offering insight into the technologies, products and processes that can help you seize today’s and tomorrow’s opportunities.

What's Trending

Commercial Banking

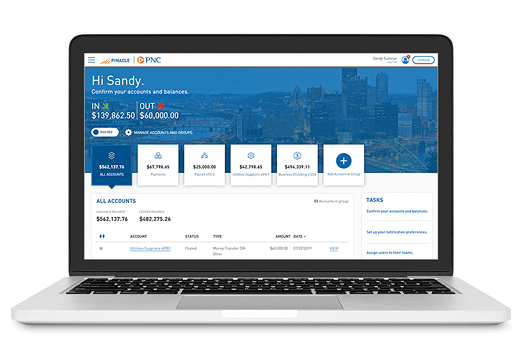

Wherever you are, PINACLE provides you with the tools and resources you need to help move your business forward. Stay informed of your organization’s daily cash position, make payments (RTP, ACH, Bill Pay and Wire), streamline receivables, initiate account transfers, and view loan and card information. Built for the way you work, PINACLE has what you need to tap into your business any time.

The PNC Commercial Rewards Card

With the PNC Commercial Rewards Card, you earn points on purchases which can be redeemed for cash back or items such as gift cards and travel. No Annual Fee. No Employee Card Fees. 1.5% rewards on qualifying purchases.

Business Risk Management Solutions

Identify your primary business risks and discover new ways to mitigate them.

- Tools to Manage International Transaction Risks.

- Ways to Help Fight Payments Fraud.

- Interest Rate Risk Mitigation.

- 1

- 2

- 3

Ideas & Insights

Learn how our clients work with us to deploy capital to expand operations, mitigate risk, increase fraud prevention and drive domestic and international business results

Gain Market Insight

PNC 2026 Business Outlook: Unlocking Stability in the Year Ahead

As uncertainty clears, M&A activity, AI and agility are all likely to play a big role in the landscape for 2026.

2 min read

Gain Market Insight

CFOs Reveal How Uncertainty Boosts Agility and Efficiency

Discover how CFOs are using economic uncertainty to drive innovation, streamline operations, and boost growth.

2 min read

Gain Market Insight

Money Is Every Woman’s Business | Entrepreneurship with Lush Decor

Jenny Jing Zhu, the founder of Lush Decor and author of Dream Weaver, shares her inspiring journey and advice for entrepreneurs.

3:38 min video

Ready to Get Started? Let's Talk.

Are you ready to explore the ways PNC can help you build your business?

If you have questions or would like additional information, please fill out this short form so we can get in touch with you. By completing this form, you are authorizing us to contact you (via email and/or phone) to answer your questions and provide information about PNC products and services.

PNC’s Commercial Banking group serves companies with $5 million to $50 million in annual revenue. If that sounds like you, complete the form below.

If your company’s revenue is under $5 million, our Business Banking team can be of service.