PNC Alerts are free to customers. However, third party message and data rates may apply. These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply.

PNC Direct Deposit

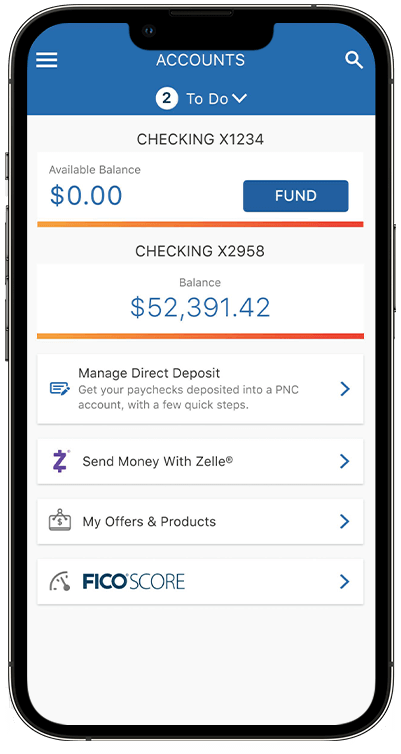

Set Up Direct Deposit with PNC.

Set Up Direct Deposit

Direct deposit allows you to electronically deposit your paycheck, pension, Social Security or other regular income from your employer or an outside agency.

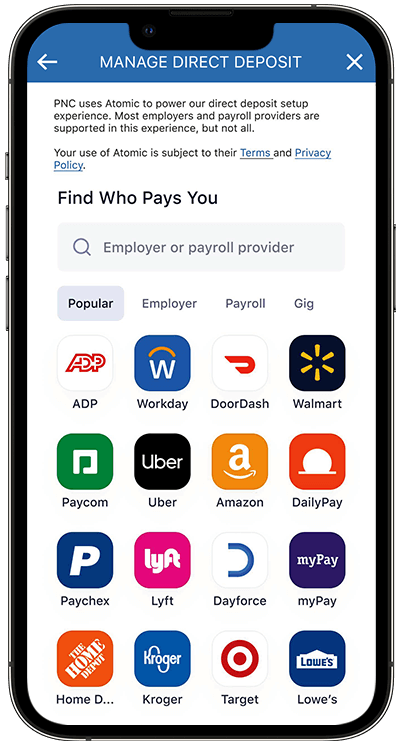

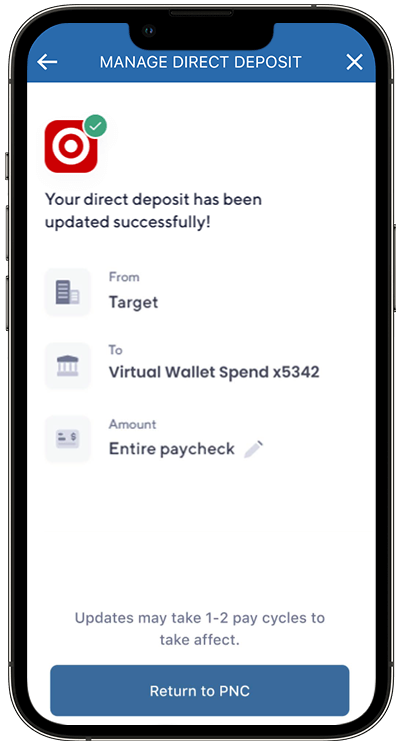

Once it’s set up, you can also manage your direct deposit however works for you. Split your funds between PNC accounts, add gig economy jobs, and change your allocations anytime.

Follow these steps to set it up securely with the PNC Mobile app – it’s fast and easy, and there’s no need to fill out a form or provide your account number.

Alternative Options to Set Up Direct Deposit

Account & Routing Number

Some employers only need your full account and routing number.

Direct Deposit Enrollment Form

If your payer doesn’t have a form for you to use, you can use ours.

Government Payers – Enroll Online

For Social Security and other government benefits, you can enroll online with Go Direct.

Why Set Up Direct Deposit with PNC?

Same-Day Access to Deposits

Funds are available when deposited – usually midnight on your payday.

Account Benefits

If your qualifying direct deposit amount meets certain balance thresholds, we may waive your monthly service charge on select checking accounts.

Convenient

You won’t need to deposit a check at a branch or ATM.

Frequently Asked Questions

Depending on your payer and their system, it can take anywhere from a day to a few weeks. Confirm with your employer or payer how long you may need to wait.

For Social Security or other payments made by the government through Go Direct, it typically takes one to two pay cycles, or four to six weeks, to process. You might get one or two more paper checks before your direct deposit begins.

Direct Deposit involves coordination between your payer and your PNC account. As a result, it can be confusing trying to understand who to contact for assistance. The guidance below may help clarify where to go for support.

- For assistance with setting up Direct Deposit, contact your employer to determine what they need.

- For newly set up direct deposit you haven't received after a few weeks, contact your employer first to check their processing time and confirm your information.

- If you are missing an expected direct deposit, contact us first so we can begin the research. If you need to contact your employer, we’ll let you know.

- Switching banks or employers? If so, try the steps in the Switch Direct Deposit section of this page. If that doesn’t work, contact us.

- For issues or questions about your pay amount, contact your employer.

PNC's Virtual Wallet® products will waive the monthly service charge with qualifying direct deposits. The amount of deposits and monthly service charge fee can vary depending on the type of Virtual Wallet product. Check your Consumer Fee Schedule for your fee and ways to waive it.

Direct deposit isn’t the only way to waive the monthly service charge fee – check your Consumer Fee Schedule for a complete list of ways.

Alerts[1] can notify you by email and/or text message when funds are deposited to your PNC account, including by direct deposit. The alerts feature also offers many other notification options to keep you informed and in control of your money.

It typically takes 1 – 2 pay periods for your direct deposit to become active, you’ll know if it’s active when you receive the funds on your payday.

There are thousands of employers supporting close to 80% of payees in the United States. If you can’t find your employer or payroll provider, you can submit a copy of the PDF form on pnc.com to your employer for processing.