PNC does not charge a fee for Mobile Banking. However, third party message and data rates may apply. These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply. Also, a supported mobile device is needed to use the Mobile Banking App. Mobile Deposit is a feature of PNC Mobile Banking. Use of the Mobile Deposit feature requires a supported camera-equipped device and you must download a PNC mobile banking app. Eligible PNC Bank account and PNC Bank Online Banking required. Certain other restrictions apply. See the mobile banking terms and conditions in the Digital Services Agreement.

Mobile Banking

Bank Virtually Anywhere, Anytime, with the PNC Mobile App.

PNC Mobile App

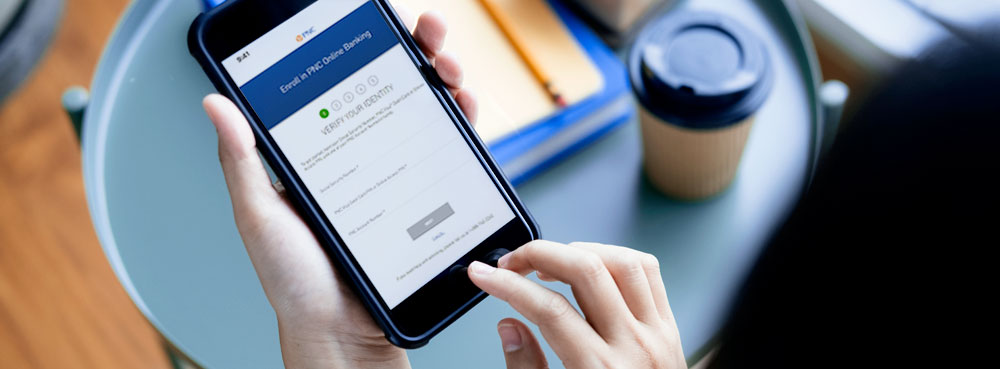

To get started in Online Banking, enroll here, or download the PNC Mobile App and tap enroll.

With the PNC Mobile App, you can:

- Manage your accounts: Check your balance, view transactions and easily transfer funds between PNC and non-PNC accounts[3]

- Set up Direct Deposit: It’s fast and easy, and there’s no need to fill out a form or provide your account number.

- Deposit checks on the go[1]: Snap a picture of your check to deposit funds and you may have an option to access your money faster, with a fee, using PNC Express Funds[4].

- Pay bills: Add your bills and make one-time or recurring bill payments[5].

- Send and receive money with Zelle®: With just an email address, U.S. mobile phone number, or Zelle® QR Code, you can quickly send and receive money with people and eligible businesses you know and trust—it’s fast, easy, and free in the PNC Mobile app[6].

- Pay with a tap: Link your eligible PNC credit or debit card to a mobile wallet to help make shopping in-store, in-app or online a breeze.

- Enjoy rewards: View, activate and redeem Purchase Payback®[7] offers.

- Customize your card: Upgrade your card design for free. Choose from options like sports, universities, military branches and LGBTQ+.

- Know who has your card info: Easily view a list of merchants where you have shared your card information for purchases or recurring transactions – all in one place. Go to Cards > Digital Card Management to view your list.[8]

- Lock your card in real time: Use PNC Easy Lock®[9] to lock your debit or credit card, keeping it from being used for new purchases, cash advances or withdrawals.

- Set a travel notification: Set a notification for travel plans including dates and locations to help avoid your transactions or ATM withdrawals from being flagged as fraudulent.

- Take control: Keep track of how, when and where your PNC accounts are accessed with the PNC Control Hub.

- Connect with PNC: Request help through the PNC Help Center by sending a message through the app, requesting a call, scheduling an appointment or tweeting PNC.

- manage

- pay

- secure

Introducing PazeSM

A convenient way to check out online. Paze makes it fast and easy to check out online without sharing your actual card numbers.

Introducing PazeSM

A new, convenient way to check out online. Paze makes it fast and easy to check out online without sharing your actual card numbers.

PNC Low Cash Mode®

Everyone can have a Low Cash Moment, we're here to help if you do.

- $0 non-sufficient funds fee

- Maximum one $36 overdraft item fee per day

- Customized alerts when your balance is low

- 24 hours minimum Extra Time to bring your balance to at least zero[11]

Built on patents-pending technology, Low Cash Mode comes with PNC’s industry-leading Virtual Wallet® and is available through the PNC Mobile app[12,1]

Bank at your convenience using the PNC Mobile app with your smartphone or tablet.

Hablas Espanol?

Go to Profile & Settings, then App Language and choose Spanish.