Important Investor Information: Brokerage and insurance products are:

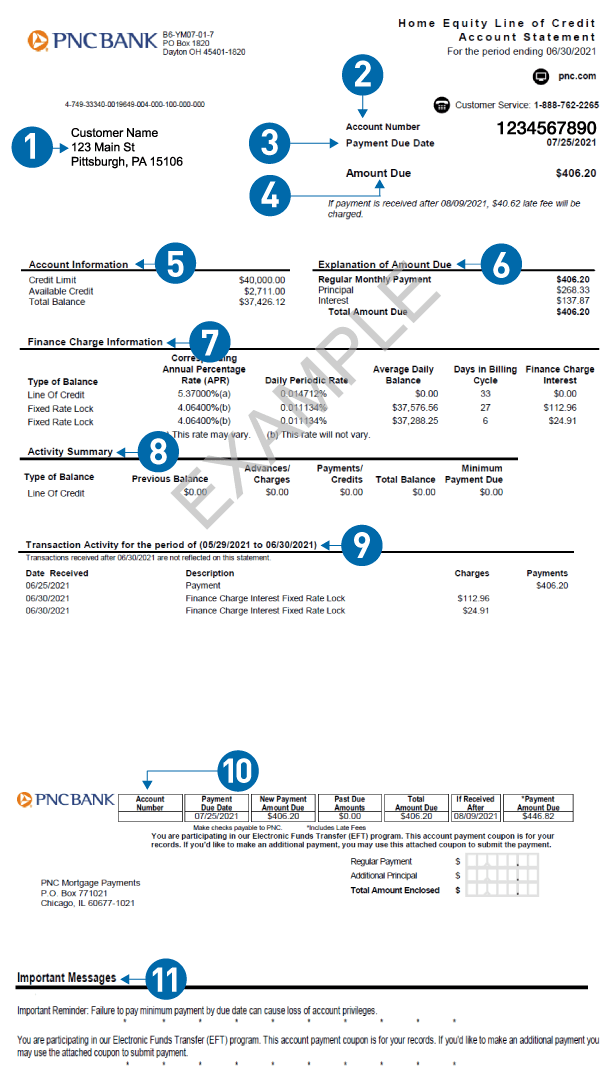

Reviewing Your Home Equity Line of Credit Statement

Customer Name:

Customer name and mailing address.

Account Number:

Account number identifies your Home Equity Line of Credit with PNC.

Payment Due Date:

The date your Home Equity Line of Credit payment is due.

Amount Due:

The total amount due as of this billing period.

Account Information:

This section is used to show the credit limit, available credit, and total balance on the Home Equity Line of Credit account.

Explanation of Amount Due:

A detailed explanation of the items that comprise the amount due as of this billing cycle. In addition to the principal and interest amounts due, this section may also include any new fees (e.g., late fees, annual fees, non-sufficient fund fees) or previously charged fees that remain unpaid, along with any other past due payment amounts (the amount of any unpaid regular monthly payments from prior billing periods).

Finance Charge:

This section displays the types of balances and the corresponding Annual Percentage Rate for each, along with the amount of interest that has accrued during the billing period.

Activity Summary:

A review of all credit advances and charges on the account during the billing cycle, along with all payments and credits applied to the account.

Transaction Activity: A list of the transactions that have taken place since the last billing statement.

Billing Statement Payment Information:

This section identifies what you must pay and by what date to avoid late fees. When paying with a check, this section should be removed and used as a payment coupon returned with your check.

Important Messages:

This section is used to communicate with you about additional important information from PNC.