PNC does not charge a fee for Mobile Banking. However, third party message and data rates may apply. These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply. Also, a supported mobile device is needed to use the Mobile Banking App. Mobile Deposit is a feature of PNC Mobile Banking. Use of the Mobile Deposit feature requires a supported camera-equipped device and you must download a PNC mobile banking app. Eligible PNC Bank account and PNC Bank Online Banking required. Certain other restrictions apply. See the mobile banking terms and conditions in the Digital Services Agreement.

Open a Checking Account Online

Find the account that fits your banking needs.

Open a Checking Account Online

Find the account that fits your banking needs.

Products & Services

Explore and apply online.

Boring Before BrillianceSM

Winning is in the details

with Scott Dixon

6x INDYCAR Series Champion

Boring Before BrillianceSM

Winning is in the details

with Scott Dixon

6x INDYCAR Series Champion

Financial Wellness

We can help you get a clear picture of where you are today and help you plan for the future you want with manageable, actionable steps.

Insights

Make today the day you take the next step toward your financial goals.

Spend

Smart Ways to Use Your Tax Refund

Wondering what to do with your tax refund? Discover the best ways to use it while avoiding common mistakes in this comprehensive guide from PNC.

7 min read

Save

Do You Pay Taxes on a Savings Account?

Do you pay taxes on a savings account? Learn how to report interest, understand IRS rules, and optimize your tax efficiency to better manage your finances.

5 min read

Borrow

How to Build Credit: 7 Key Steps

Find out how to build credit, manage payments, and keep your score healthy. Follow proven tips to establish good credit habits and avoid mistakes.

4 min read

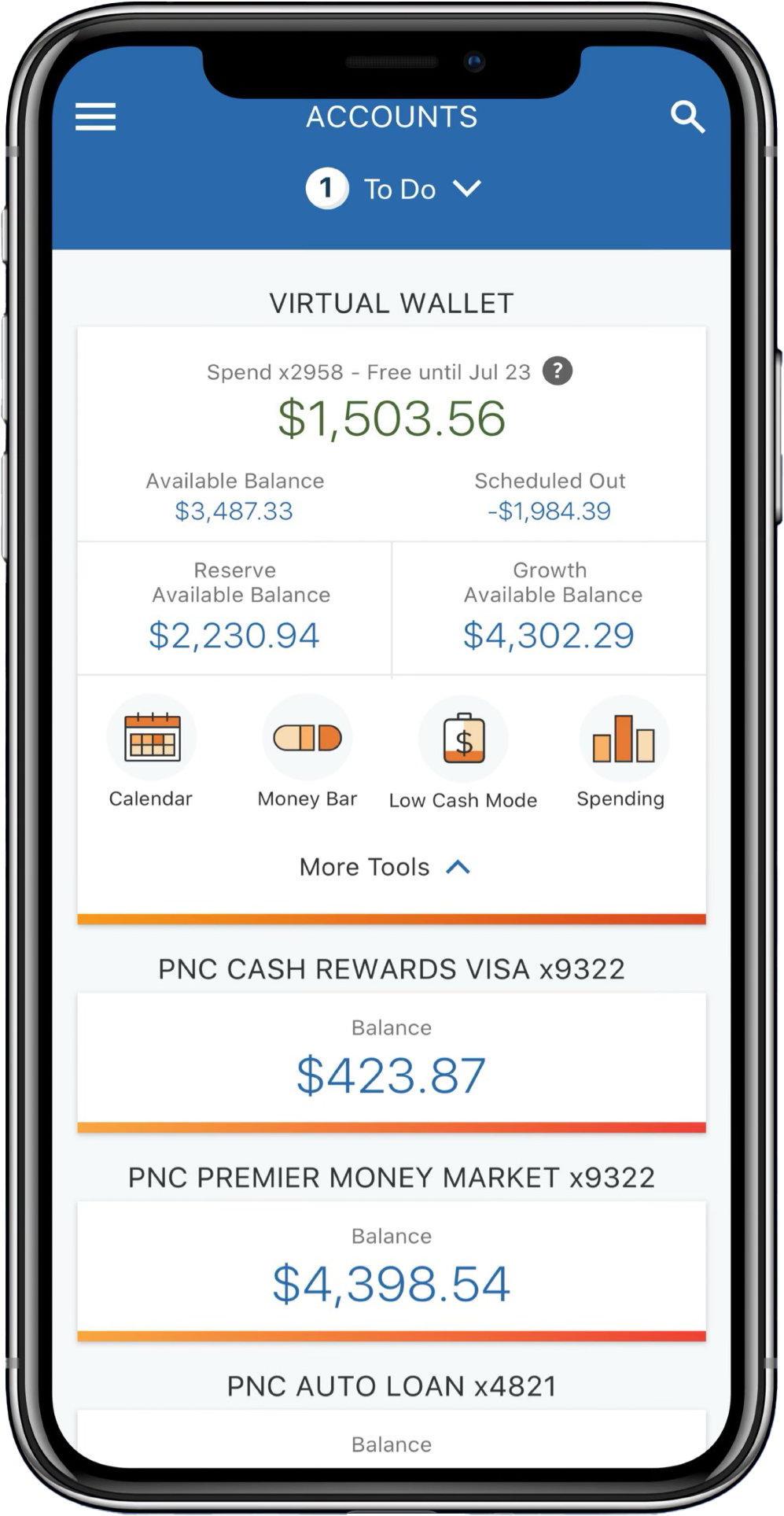

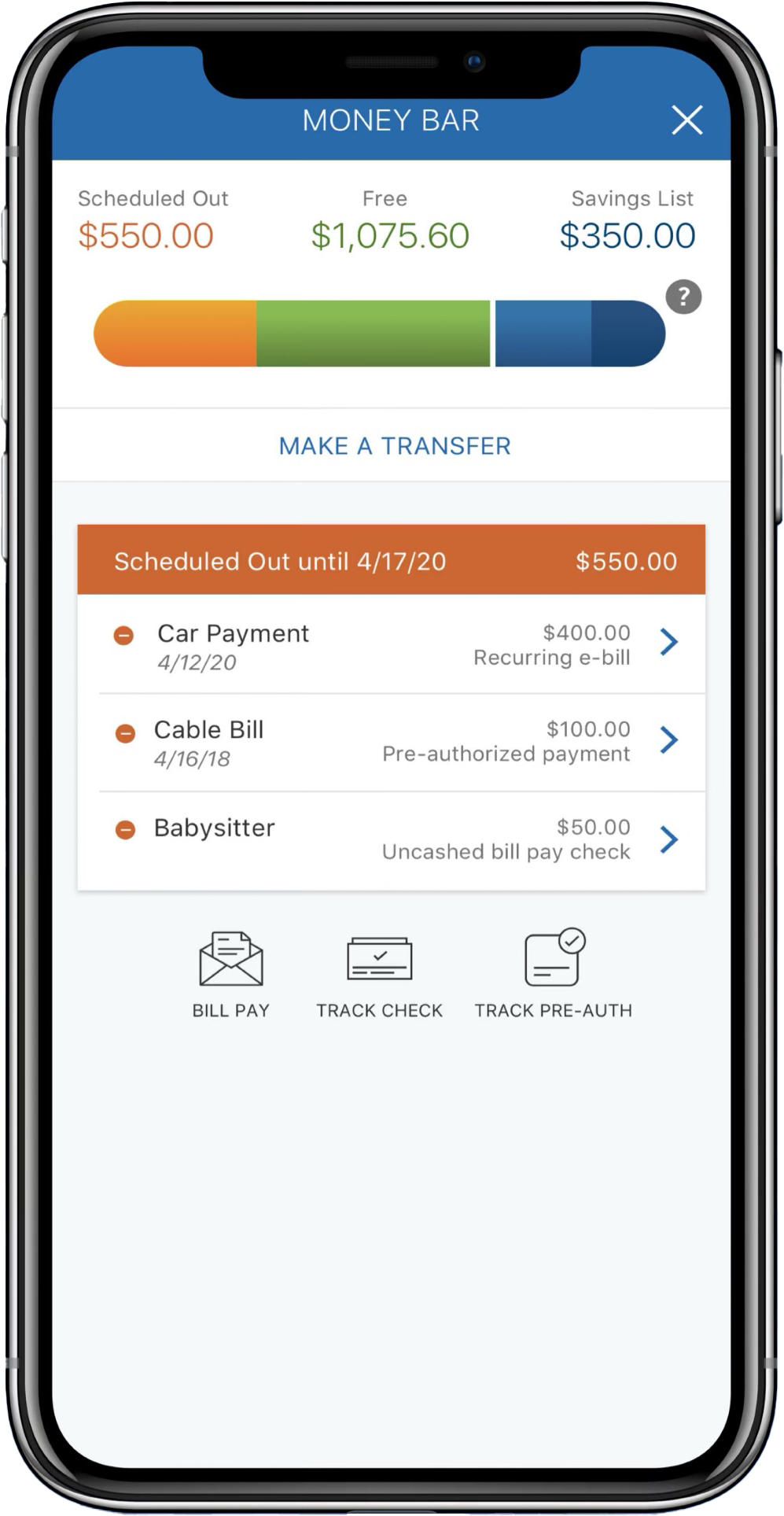

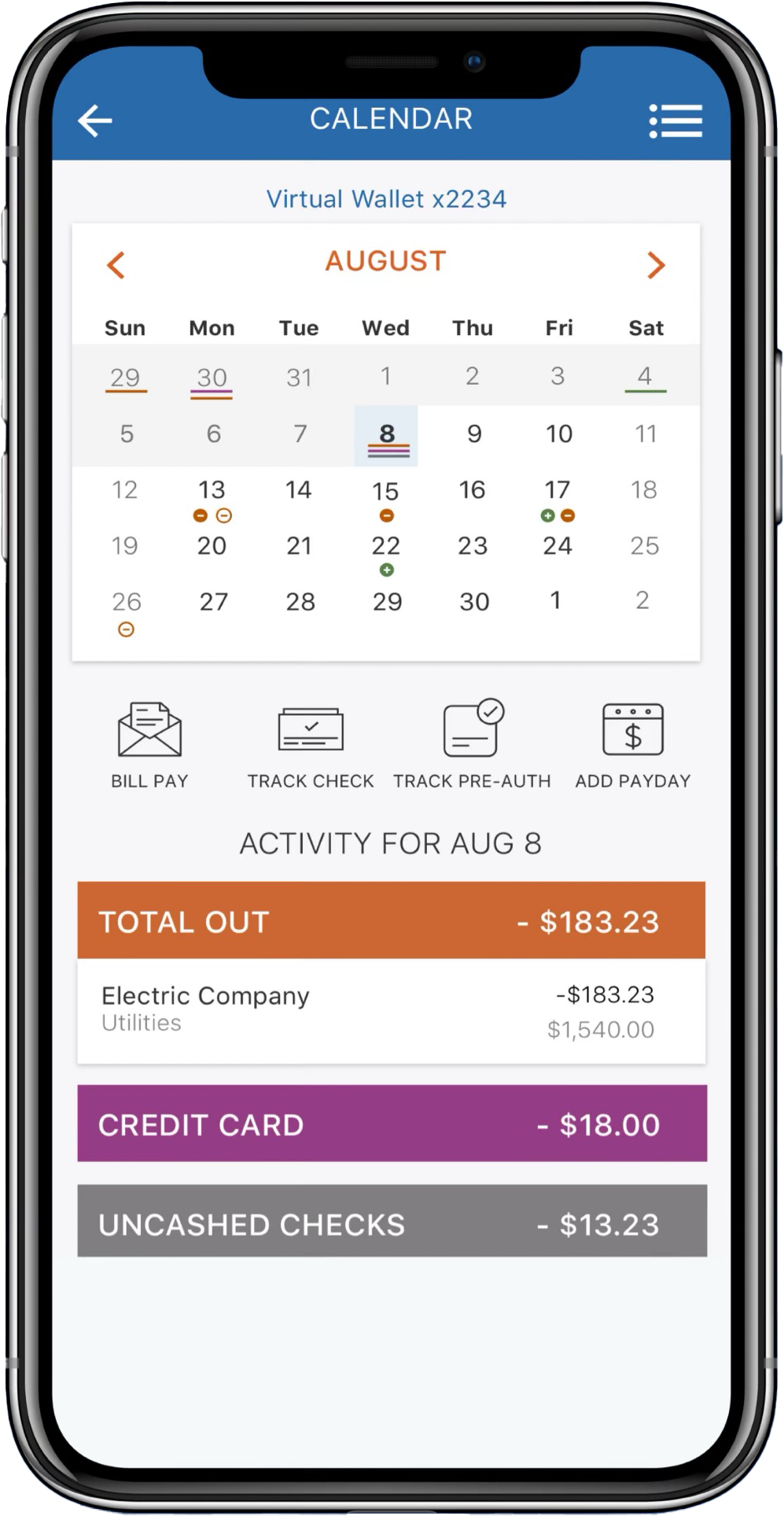

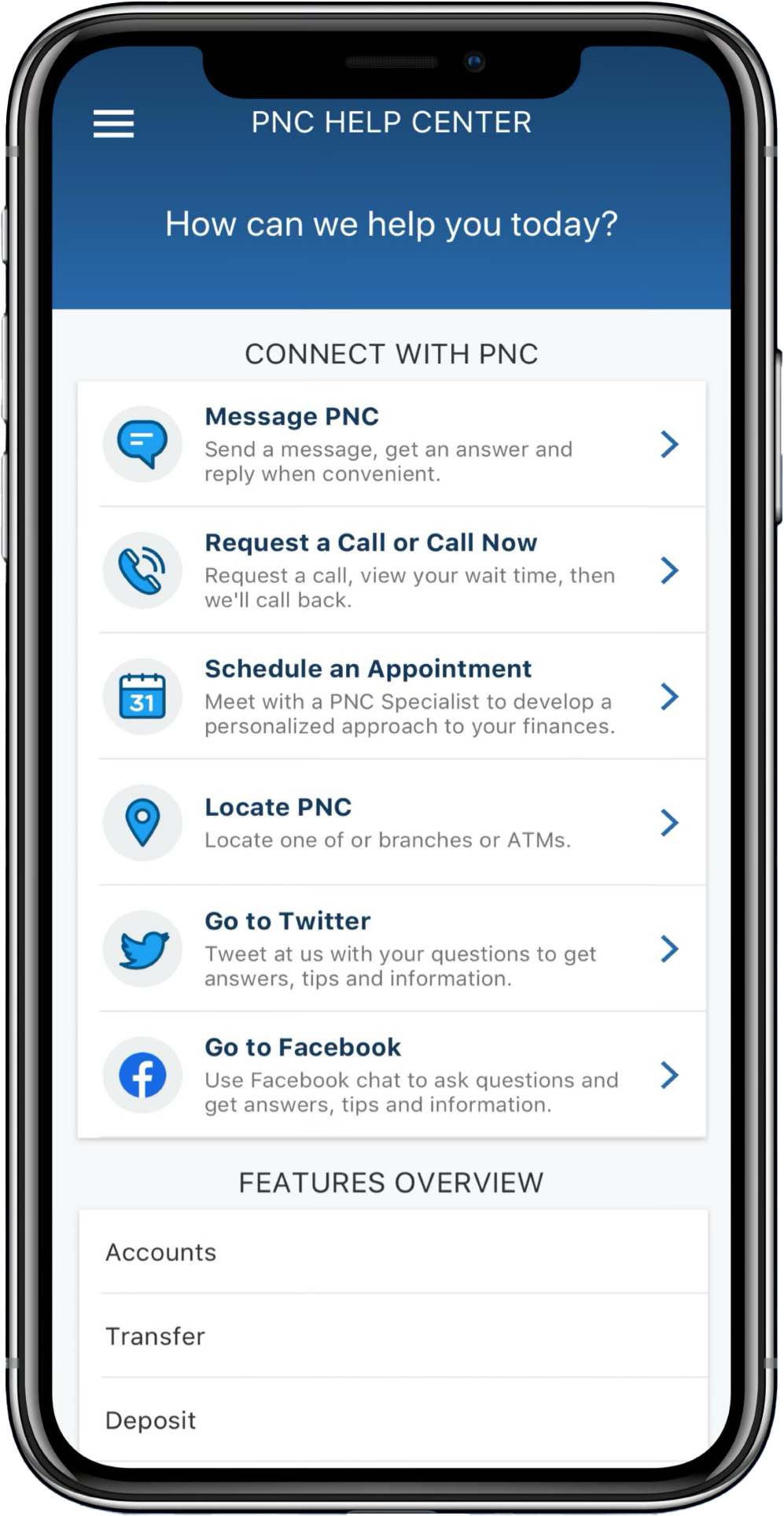

Mobile App

Bank anytime, anywhere. Get started with the PNC Mobile App. [1]

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

- 1

- 2

- 3

- 4

Download our app

Find the PNC Mobile app in the App Store or Google Play.