PNC is a registered mark of The PNC Financial Services Group, Inc.

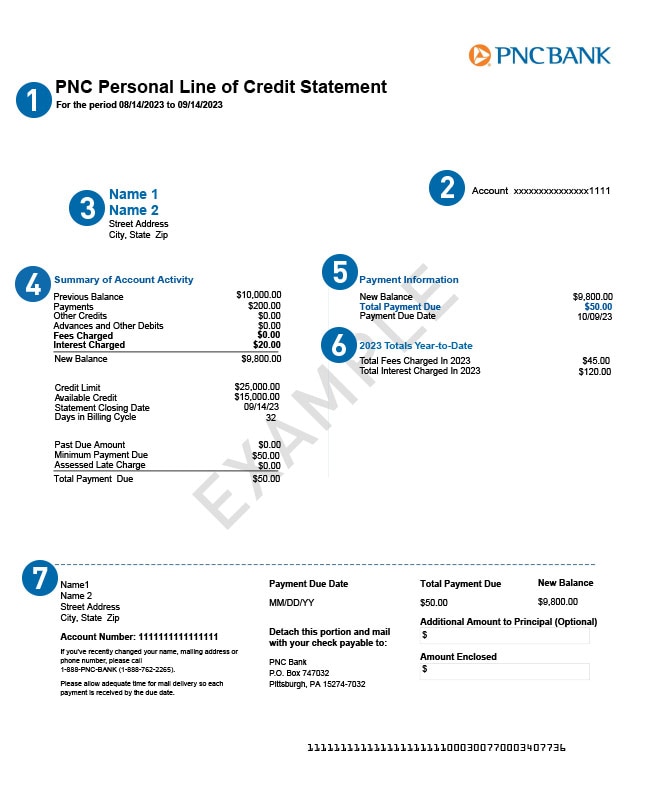

Reviewing Your Line of Credit Statement

Billing Cycle:

The beginning and ending date of the billing cycle for this statement.

Account Number:

The last four digits of your account number that identifies your Personal Line of Credit with PNC.

Customer Name:

Customer name and mailing address

Summary of Account Activity:

Detailed explanation of your account activity, including previous balance, any payments made and/or draws taken as well as any fees, if applicable. It also includes the interest charged this billing cycle, your credit limit and the breakdown of total payment due.

Payment Information:

The payment amount and date by which you need to make your Line of Credit payment.

Year to Date Totals:

Total amount of fees and interest charged this year.

Billing Statement Payment Information:

This section can be used as a payment slip, or will inform you that the payment will be automatically deducted if your line is set up for automatic payments.

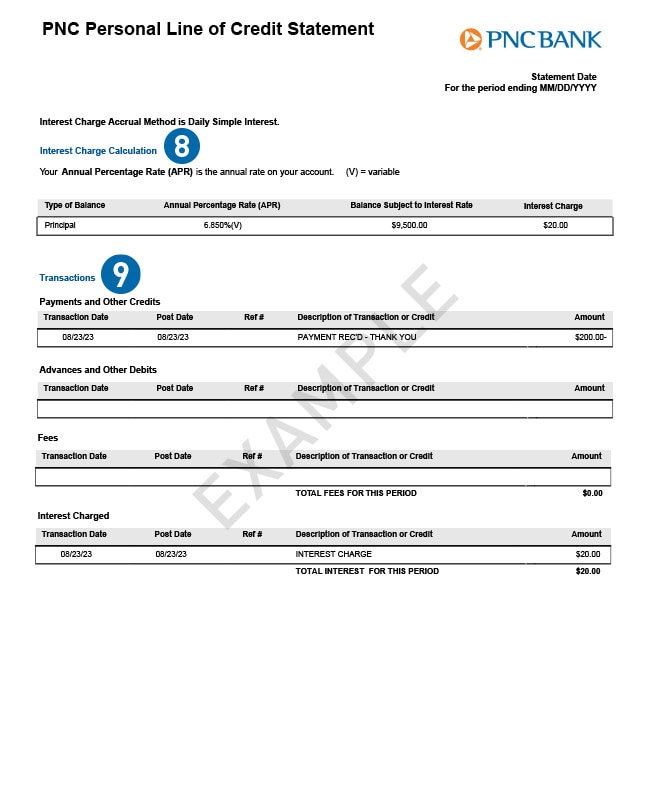

Interest Charge Calculation:

Information regarding your interest charge during the billing cycle.

Transactions:

A quick review of transactions that have taken place since the last billing statement.