Eligibility based on Customer’s checking relationship.

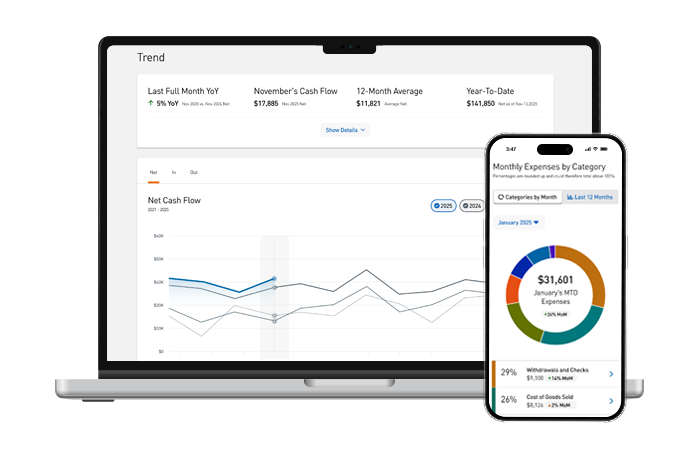

Cash Flow Insight®

A suite of cash flow management tools available in PNC Online Banking.

Transition Your Business from Physical to Virtual

Cash Flow Insight is designed to help you monitor and plan your cash flow. Enroll in Pay Receive Sync to send invoices via email, get paid online and digitally manage payables.

Overview

Manage Your Business’s Cash Flow with Efficiency, Control & Insight

Plan & Manage

Key Features & Benefits of Cash Flow Insight[1]

Included at No Cost With Eligible PNC Business Checking Accounts

Experience Pay Receive Sync. No Cost for 60 Days.[2]

Pay Receive Sync

Add-On Features & Benefits[3,4]

Compare

Discover the Best Online Experience for Your Business

Frequently Asked Questions

No. Pay Receive Sync complements your accounting system to integrate and record current payment data of your customers and/or vendors, while helping to simplify your account reconcilement.

Yes. You can set-up a specific role for each individual, entitling what actions can be created and/or approved for processing payments and managing your business’s cash flow.

Payables helps to enhance your current process by capturing (scan or email) and storing your bills and contract documentation in Online Banking. From there, authorize and route the payment for approval and increase security with check payments and/or offer electronic payments to more vendors/suppliers. Compare online experiences

News & Insights

Insights and ideas to help you get the most out of your day and keep your business moving forward.

Manage Business Finances

Boost Cash Flow During Growth Periods with Business Lending

Discover effective strategies for using business lending to improve cash flow during growth periods and keep your business thriving.

9 min read

Manage Business Finances

8 Ways to Reduce Excess Inventory to Free Up Space and Cash

Learn 8 practical ways to manage excess inventory, boost cash flow, minimize losses, and turn slow-moving stock into customer engagement opportunities.

3 min read

Manage Business Finances

Managing Client Payments & Invoicing for Better Cash Flow

Professional service providers may improve cash flow by using stronger invoicing practices, digital payment tools and banking solutions.

5 min read