Eligibility based on Customer’s checking relationship.

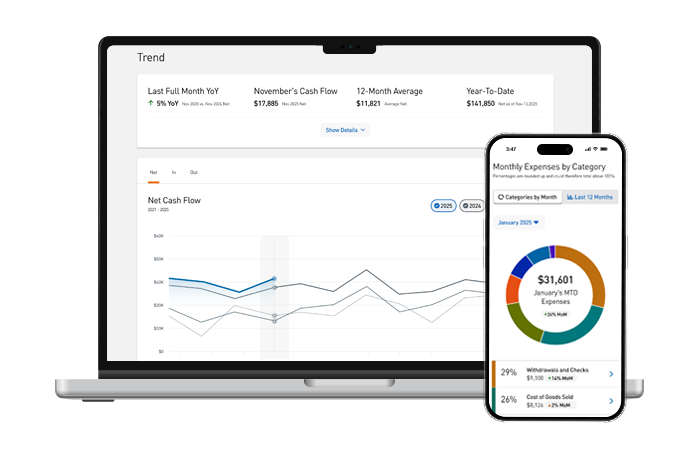

Cash Flow Insight®

A suite of cash flow management tools available in PNC Online Banking.

Transition Your Business from Physical to Virtual

Cash Flow Insight is designed to help you monitor and plan your cash flow. Enroll in Pay Receive Sync to send invoices via email, get paid online and digitally manage payables.

Overview

Manage Your Business’s Cash Flow with Efficiency, Control & Insight

Plan & Manage

Key Features & Benefits of Cash Flow Insight[1]

Included at No Cost With Eligible PNC Business Checking Accounts

Experience Pay Receive Sync. No Cost for 60 Days.[2]

Pay Receive Sync

Add-On Features & Benefits[3,4]

Compare

Discover the Best Online Experience for Your Business

Frequently Asked Questions

No. Pay Receive Sync complements your accounting system to integrate and record current payment data of your customers and/or vendors, while helping to simplify your account reconcilement.

Yes. You can set-up a specific role for each individual, entitling what actions can be created and/or approved for processing payments and managing your business’s cash flow.

Payables helps to enhance your current process by capturing (scan or email) and storing your bills and contract documentation in Online Banking. From there, authorize and route the payment for approval and increase security with check payments and/or offer electronic payments to more vendors/suppliers. Compare online experiences

News & Insights

Insights and ideas to help you get the most out of your day and keep your business moving forward.

Manage Business Finances

Give Customers More Ways To Pay: Turning Choice into Higher Sales

Give customers more ways to pay by incorporating cards, wallets, ACH, and pay-by-link to reduce friction, boost sales, and improve cash flow.

3 min read

Manage Business Finances

Deposit Accounts for Manufacturers: Pay Suppliers Without Draining Cash

Use a business checking account to align payables with production timing, preserve liquidity, capture early-pay discounts, and strengthen supplier relationships.

3 min read

Manage Business Finances

From Cart to Cash: Reconciling Marketplace Payouts

Restore cash visibility in e-commerce with a deposit account, daily reconciliation, and integrated merchant reporting for faster closes and cleaner books.

3 min read