Banking products and services and bank deposit products are provided by PNC Bank, National Association, a wholly-owned subsidiary of The PNC Financial Services Group, Inc. and Member FDIC.

Business Credit Card

Consolidated Billing

Manage your finances easier with one clear view and one quick payment.

A Unique Account Management Structure

Our business credit card accounts are structured differently to give business owners more efficient control managing their PNC business credit card accounts when using PNC Account View or PNC Online Banking.

Understanding the Control Account and Sub-Account(s)

Credit card activity all rolls up to a single Control Account. Your billing statement for the Control Account will include transactions from all your employees' cards (also called Sub Accounts).

Why It Matters

Consolidated Billing doesn’t just make it easier to pay bills. It also gives you valuable insight into your company’s spending and greater control over who’s doing it — so you can run a tighter ship and keep your operation running efficiently.

Frequently Asked Questions

Consolidated Billing for PNC business credit cards is available in both Account View and PNC Online Banking. To register or login to either service, click the Sign On button in the upper right hand corner of any pnc.com page.

- For Account View access, display the "Select Another Service" dropdown list and select "Account View" to Sign On or Register Now.

- For PNC Online Banking, use the Sign On or Enroll section.

Consolidated Billing provides a complete, streamlined view of your company’s transaction activity, no matter which employee initiates it. Under this structure, all transaction activity on any of the credit cards issued under your business rolls up to a single master account known as the Control Account. At the end of each billing cycle, you will receive one billing statement that shows all transactions on your business credit card account by cardholder Sub-Account.

A Control Account is the master account number that allows you to view all of your company’s credit card activity for all credit cards associated with it. When making any balance or payment inquiries, always refer to the Control Account number for consistency and identification purposes.

A Control Account has a unique account number that doesn’t match any of the account numbers imprinted on the credit cards issued under your company’s account. No credit card is issued for a Control Account.

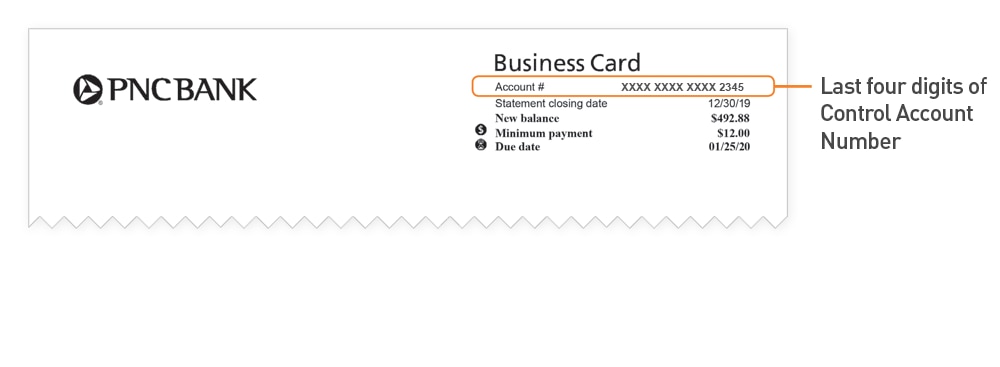

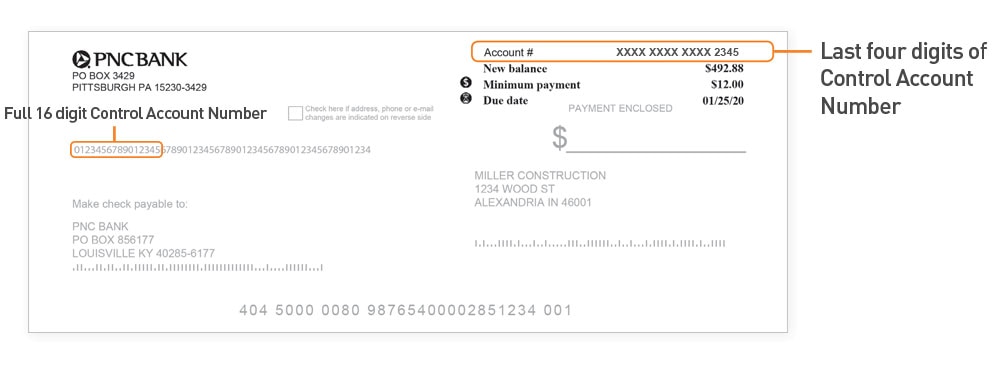

The last four digits of the Control Account number appear at the top of your statement. The full Control Account Number is on the payment coupon on each statement.

Billing Statement

Payment Coupon

Payments are always applied to the Control Account, not to a Sub-Account. Remember to include the Control Account number with your payment.

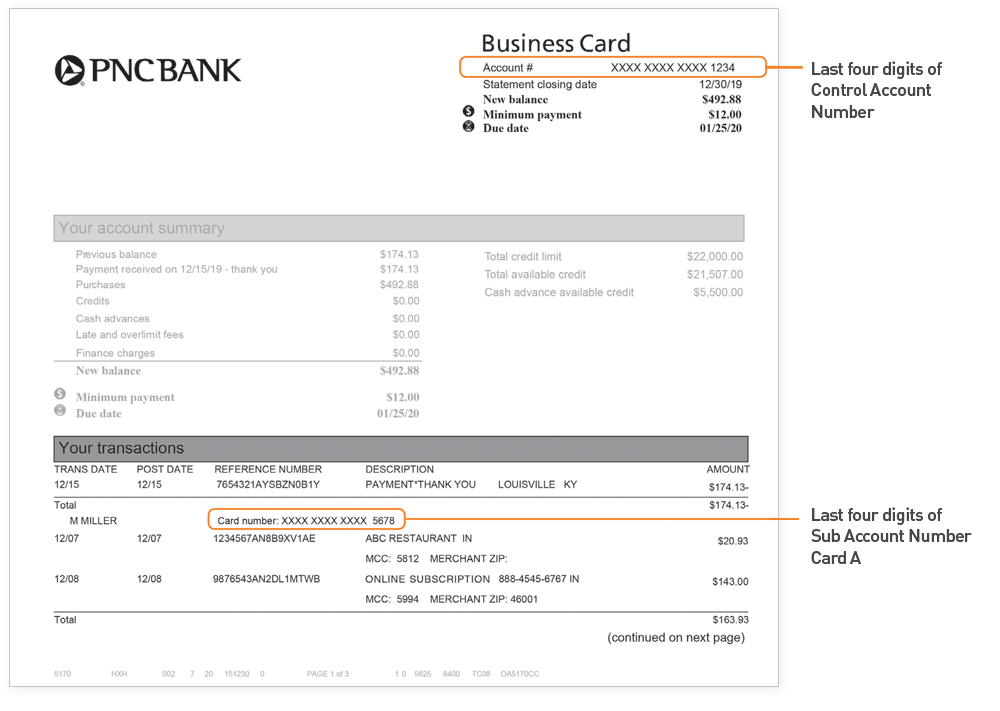

A Sub-Account is established for each cardholder (owner/guarantor/co-borrower and employee), so that the company can easily track each cardholder’s credit card account number and activity.

Sub-Account transactions are subtotaled for each cardholder and included on the Control Account billing statement.

Billing Statement

The balance for each Sub-Account will be zero at the beginning of each billing cycle, because all transactions have rolled up to the Control Account.