PNC does not charge a fee for Mobile Banking. However, third party message and data rates may apply. These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply. Also, a supported mobile device is needed to use the Mobile Banking App. Mobile Deposit is a feature of PNC Mobile Banking. Use of the Mobile Deposit feature requires a supported camera-equipped device and you must download a PNC mobile banking app. Eligible PNC Bank account and PNC Bank Online Banking required. Certain other restrictions apply. See the mobile banking terms and conditions in the Digital Services Agreement.

Open a Checking Account Online

Find the account that fits your banking needs.

Open a Checking Account Online

Find the account that fits your banking needs.

Products & Services

Explore and apply online.

For what you're planning - and for life's surprises.

Did you know a loan could help you meet your goals and stay on track?

Whatever you are facing, whether it's managing daily spending, making a major purchase or consolidating debt, we have resources to help you find what works best for you. You can browse caluclators and tools, informative articles, apply for products online, or schedule an appointment to talk with us.

Insights

Make today the day you take the next step toward your financial goals.

Borrow

Consumer Lending in 2026: Trends, Takeaways, and the Road Ahead

Here’s what defined the last year in consumer lending – and what borrowers might expect in 2026.

4 min read

Invest

How To Retire Early: A Roadmap to Reaching Your Dreams

Discover how to retire early with this comprehensive guide. Learn to set goals, maximize retirement investing, and plan withdrawals for early financial freedom.

6 min read

Invest

Is a SEP IRA Right for You? Key Points to Consider

Learn more about SEP IRAs and how this retirement plan helps self-employed individuals and small businesses generate savings and tax benefits.

4 min read

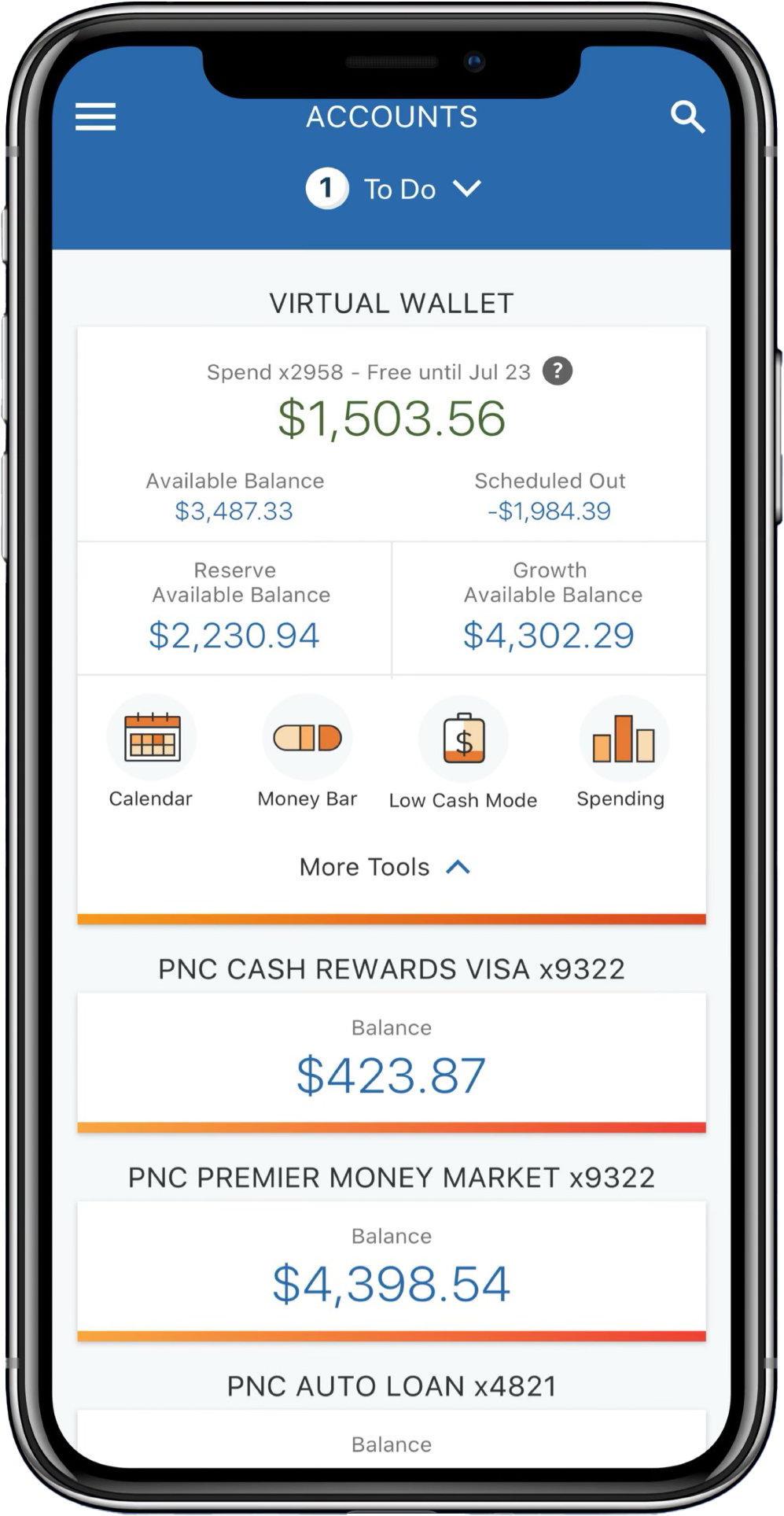

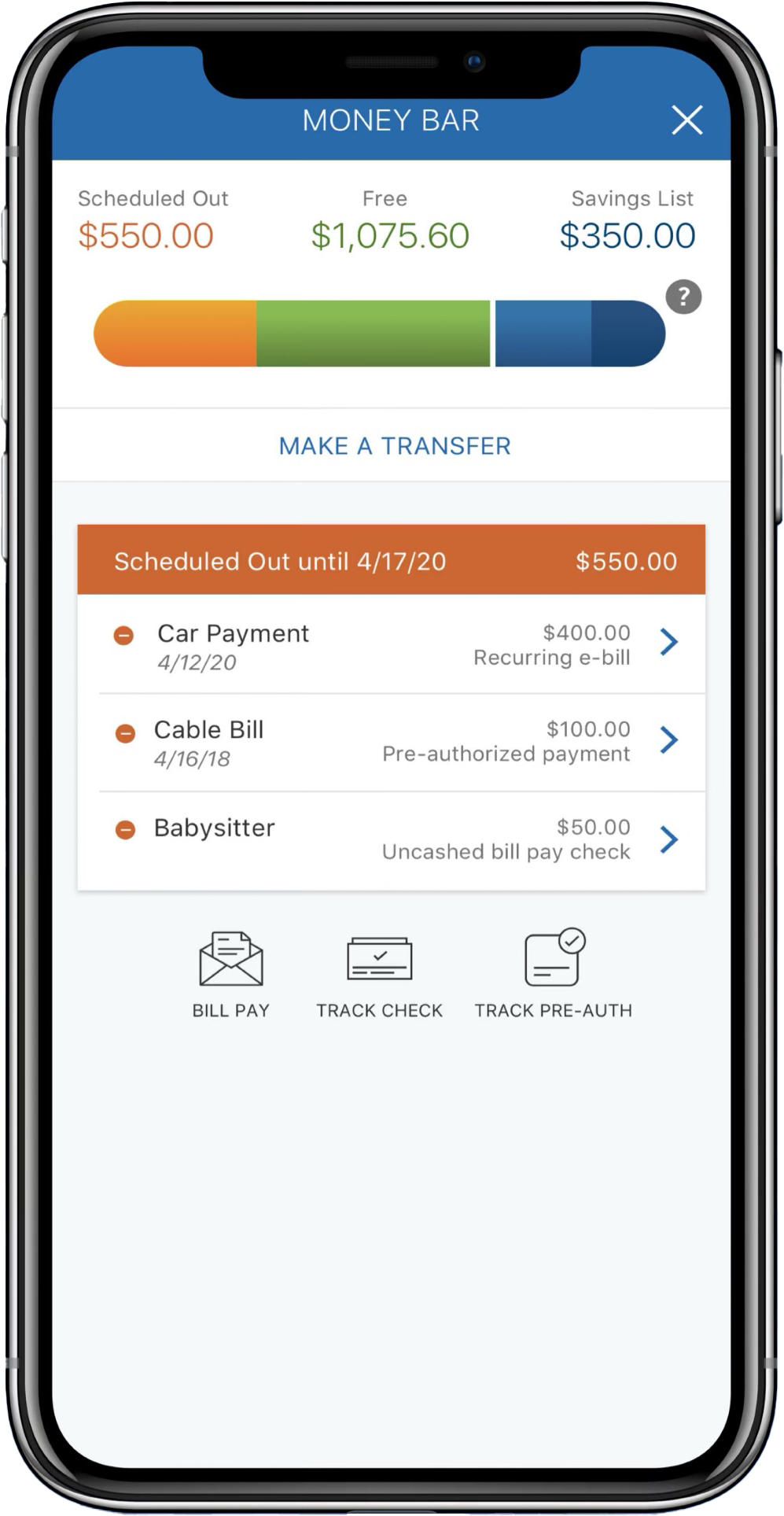

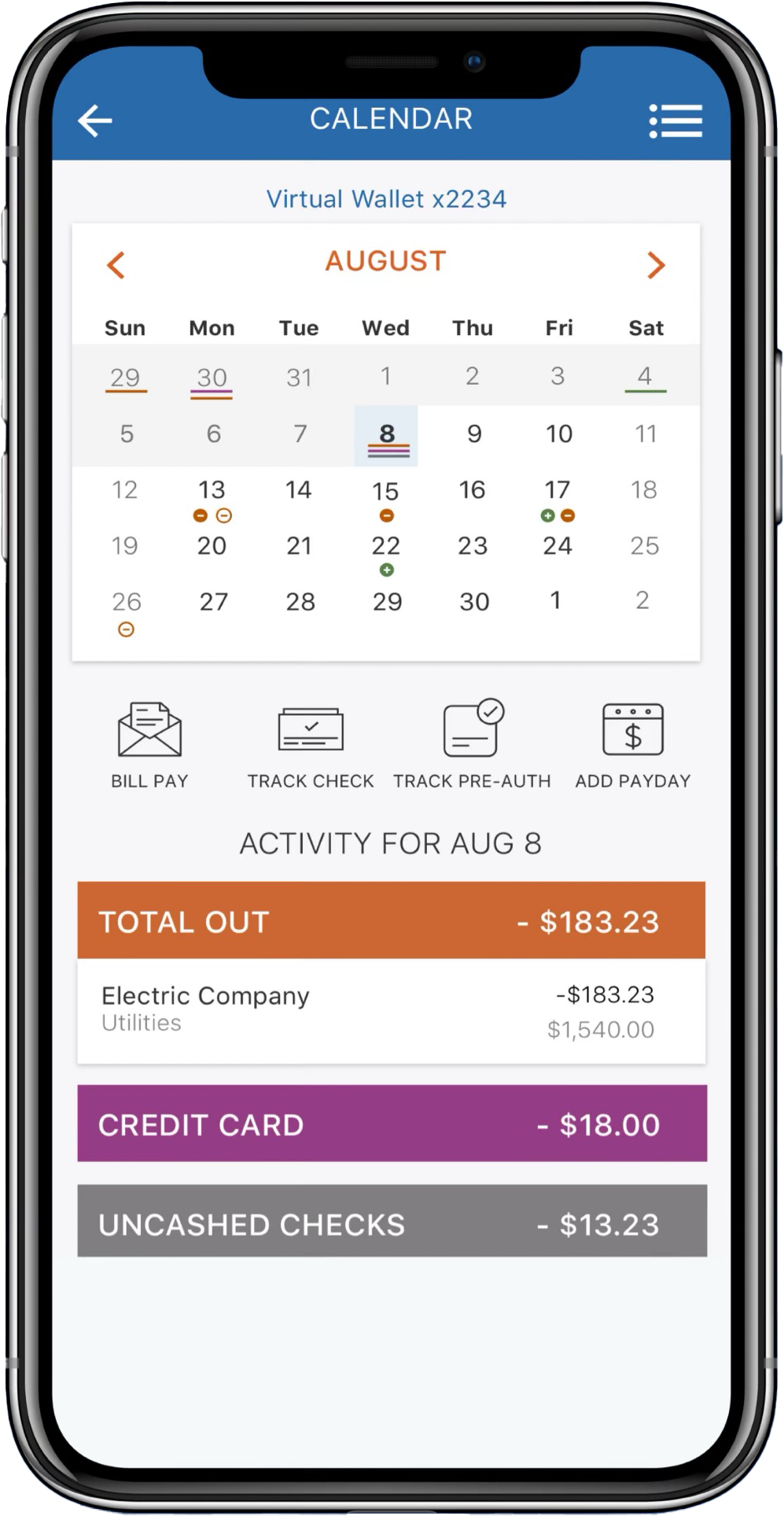

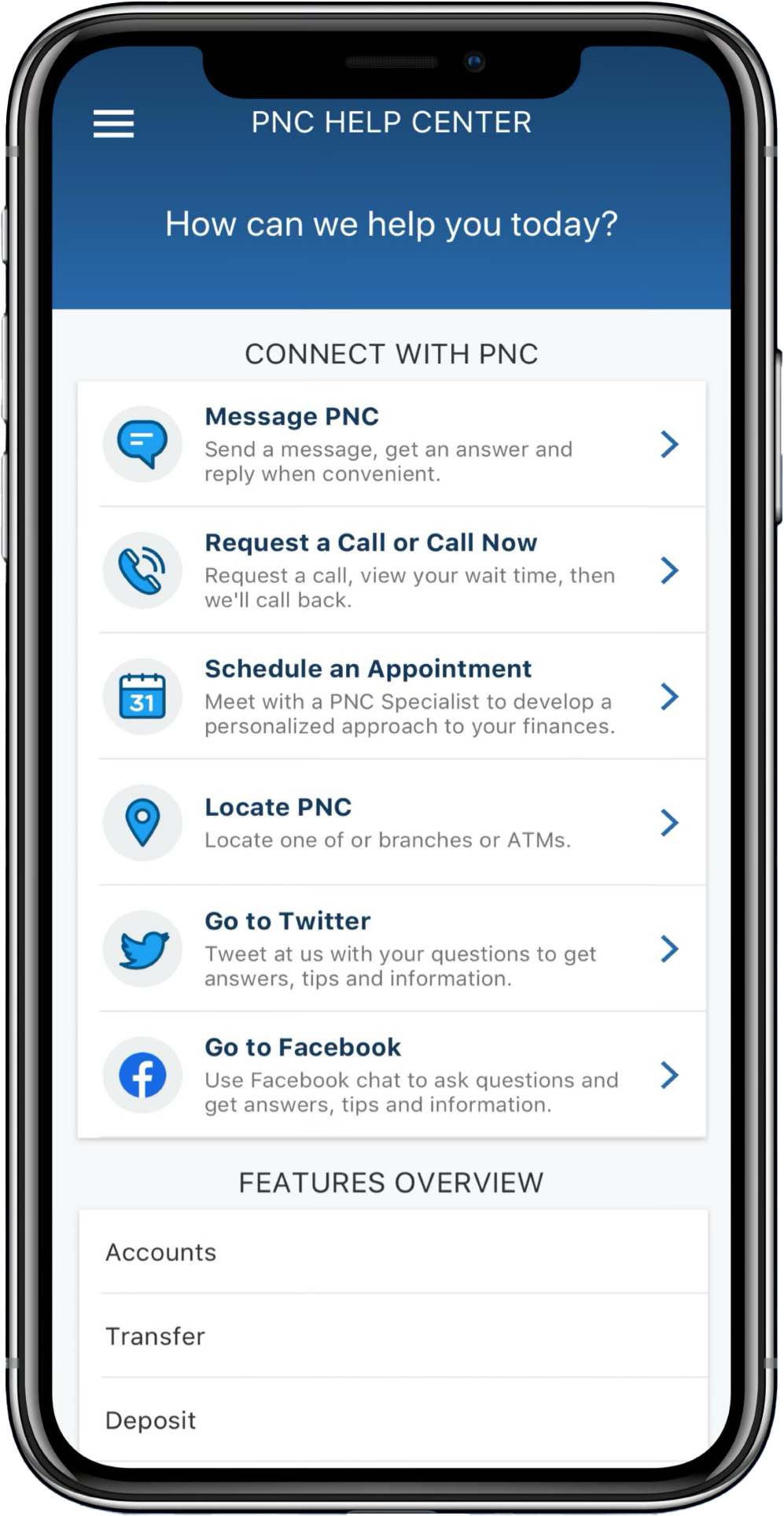

Mobile App

Bank anytime, anywhere. Get started with the PNC Mobile App. [1]

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

- 1

- 2

- 3

- 4

Download our app

Find the PNC Mobile app in the App Store or Google Play.