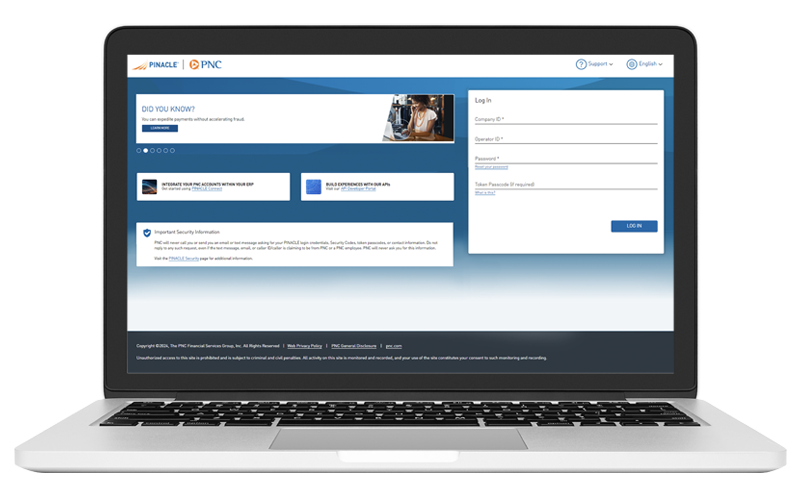

PINACLE® Corporate Online Banking

Take Care of All Your Business

Whether you are in charge of your company’s financial strategy or responsible for day-to-day transactions, PINACLE®, PNC’s top-rated corporate online and mobile banking platform, delivers a single, customizable access point for your Corporate Banking services. Wherever you are, PINACLE provides you with the tools and resources you need in order to move your business forward. Initiate account transfers, ACH batches, Real-Time Payments or wires, manage your receivables and disbursements, or stay informed of your organization’s daily cash position, PINACLE has what you need to tap into your business 24 hours a day, 7 days a week.

Smart Tools

Integrated Receivables

Streamline your A/R research, reduce the costs associated with archiving and retaining paper and electronic documents, and enhance customer service. PNC scans checks and remittance documents received at your lockbox location, and you get same-day online access to full color images of all your receivables.

Deposit On-Site

Reduce administrative time and expense by easily capturing images of consumer and business checks received at your office. With just a click, you can transmit these images directly to PNC for processing.

Automated Clearing House (ACH)

Initiate and track ACH disbursements and collections quickly and conveniently. Import data from separate applications, use preformatted ACH templates and administer recurring transfers quickly and easily. There's no need to buy application-specific software or learn ACH terminology.

ACH Positive Pay

Effectively protect your accounts from unauthorized ACH debits. Work with rules to manage your ACH suspects. Create, save and export custom reports that are tailored to fit your needs.

Account Transfer

Move funds quickly, easily and securely between your PNC business bank accounts for same-day settlement.

Check Management

Monitor your check disbursements with ease. Check Management allows you to manage stop payments, perform check and stop inquiries, and view check images.

Check Positive Pay

Reduce disbursement risk and maintain control over check issuance and payment. Positive Pay matches checks that you have written against checks that have been presented. You can send information about individual checks directly to PNC, view suspect check images, and manage exception items.

Funds Transfer (Wires, Real-Time Payments, and more)

Control and customize access to funds transfer initiation. Easily transfer funds for same-day settlement and leverage easy-to-use templates apply to RTP as well. Send Requests for Payment and access the RTP Message Center. You can also administer security privileges for your authorized representatives to reflect your company's risk management tools.

Stay in control of your daily cash position and track transaction activity for all your accounts. Through Information Reporting, you can view your account balance detail, generate historical and custom reports and easily export data. Access a variety of standard and customized reports to see the information you want in the format that is best for you. Subscribe to notifications to be alerted to activity on your account, and take advantage of the convenience of emailed reports and statements.

Access PINACLE anytime, anywhere while using your mobile device. Make informed financial decisions and perform key treasury management functions remotely. Tap into your business anywhere you have a WiFi or cellular connection.

Quickly initiate a service request through PINACLE to report any issue you are experiencing. Track the status of service requests and stay informed on their progress. Access training resources and register for instructor-led training.

Contact our client support team, Treasury Management Client Care, for any PINACLE assistance.

Evaluate your lending needs and manage your borrowing activities more efficiently. PINACLE® Credit Management helps you perform transactions and access real-time credit information without spending unnecessary time on the phone.

Get comprehensive access to your international cash position through PINACLE®. You can initiate international payments and manage global cash flows. You can also improve security by assigning accounts and entitlements to your PINACLE operators based on need.