Low Cash Mode is only available on the Spend account of your Virtual Wallet product.

Low Cash Mode®

Take control of your account when your balance is low.

Features & Benefits

Low Cash Mode gives you more choice and control when your available balance is low or negative.

If your Spend account available balance falls below $0, you will have the ability to make certain payment decisions and Extra Time to bring your available balance positive.

Using Low Cash Mode

Before you can use Low Cash Mode, you will need to download the PNC Mobile App.[6]

- Intelligent Alerts

- Extra Time

- Payment Control

- Review Funding Options

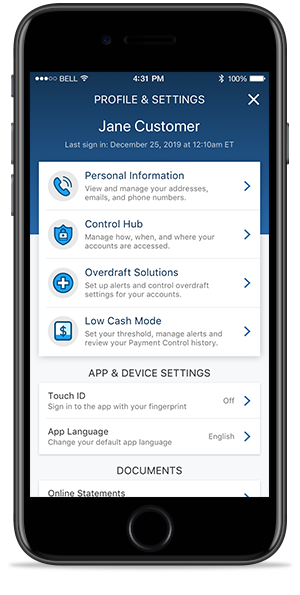

Step 1

Go to Profile and Settings in the main navigation. Select Low Cash Mode.

Step 2

Customize your Low Cash Mode threshold and set up your Extra Time alerts.

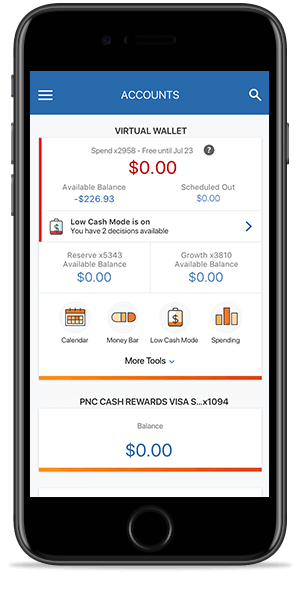

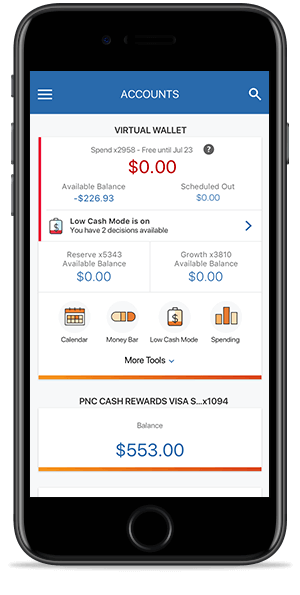

Step 1

Enter the Low Cash Mode dashboard from your Account Summary screen.

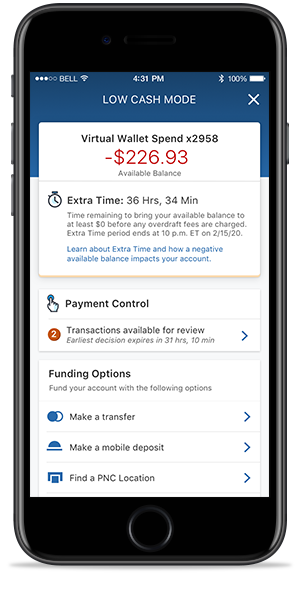

Step 2

See how much time you have to bring your available balance to at least $0 before you’re charged overdraft fees.

Step 3

If you don’t bring your available balance to at least $0, you’ll see what fees have been charged.

Step 1

Enter the Low Cash Mode dashboard from your Account Summary screen.

Step 2

Enter Payment Control to review the transactions available for a pay or return decision.

Step 3

Select a transaction to return, if desired. Your Projected Available Balance will change based on your decisions.

Step 4

Review your decision before confirming.

Step 1

Enter the Low Cash Mode dashboard from your Account Summary screen.

Frequently Asked Questions

At this time, Low Cash Mode is only available in the PNC Mobile App. For more information about downloading the PNC Mobile App, visit www.pnc.com/mobile.

Your Extra Time clock starts as soon as your available balance becomes negative.

Your Extra Time ends when you bring your available balance to at least $0 or when your Extra Time expires.

With Extra Time, if your account becomes overdrawn on a business day, you will have until 10 p.m. Eastern Time on the next business day to bring your available balance to at least $0 to avoid an overdraft item fee.

If a transaction occurs on a Friday after 10 p.m. Eastern Time, it will count towards Monday’s activity, meaning your Extra Time will end Tuesday at 10 p.m. Eastern Time.

PNC Extra Time will provide you with additional time to fund your account to avoid overdraft item fees.

Your Extra Time clock would restart when you went back into an overdraft status on Wednesday and you would be charged a fee on Thursday, if you didn’t fund your account by 10 p.m. ET on Thursday.

If you set up Low Cash Mode alerts, you’ll receive alerts when your Extra Time begins and ends.

If you bring your available balance to at least $0 before your Extra Time expires, you won’t be charged an overdraft item fee.

If you have not increased your available balance to at least $0 before your Extra Time period expires, your account may be assessed an Overdraft Item fee for each business day on which the ending available balance is negative and on which you made or authorized new withdrawals from your account that contributed to the negative available balance.

PNC does not charge Returned item (NSF) fees for Low Cash Mode customers.

Only checks and Automated Clearing House (ACH) items made using your account and routing number will be available in Payment Control. Debit Card transactions do not qualify for Payment Control.

Payment Control will only be available when your available balance is negative.

Overdrawing your account, maintaining a negative available balance for any period of time and returning transactions as unpaid may have consequences, including account closure or negative impacts to your ability to obtain financial services including loans, deposit accounts, and other services at PNC and other institutions.

When you choose to return an Item that has been presented to PNC for payment, we’ll return the Item to the payee’s bank for insufficient funds, and the payee won’t receive payment from PNC. You may still have an obligation to pay the payee for the goods, services or other products. PNC isn’t responsible for satisfying any obligations between the customer and the payee or any other party with respect to an item you decide to return. Before choosing to return an Item, you should consider the rules the payee may have or actions the payee may take on late/returned payments.

Items returned in Payment Control may be resubmitted by the payee up to 2 additional times so you may see them in Payment Control again.

If your available balance is insufficient to cover presented items, PNC will decide, at our discretion, which transactions to pay based on factors that may include things such as account history and customer behavior.

Pay decisions you make aren’t final until 2 p.m. ET the business day after they post to your account.

Overdraft protection in Low Cash Mode will function as it does today. In Low Cash Mode, if you have overdraft protection set up, you will see the balance in your protecting account and have the option to initiate a transfer as soon as the available balance on your account becomes negative.

If you don’t take action to initiate the transfer and your account has a negative balance at the end (10 p.m. Eastern Time) of a business day, we’ll attempt to transfer the balance needed to bring your available balance to at least $0 from your protecting account during nightly processing.

If an overdraft protection transfer brings your account to at least $0, your overdraft event will end and Payment Control may no longer be available. If the overdraft protection transfer doesn’t bring your account to at least $0, the customer will remain in Low Cash Mode.

For more information on overdraft protection visit pnc.com/overdraftsolutions.

If you have a joint account, both account owners will be able to access the Low Cash Mode dashboard and set up their alert preferences. If your available balance is negative you will both be able to see your Extra Time and any available Payment Control decisions in the PNC Mobile App.

If an item is selected to return, that decision is final and can’t be changed by the other account holders.

If an item is selected to be paid, other account holders can change that decision until 2 p.m. ET the business day after the item posts to the account.

Experience Low Cash Mode

Don't Have a Virtual Wallet®?

Low Cash Mode is currently available for all Virtual Wallet Spend products.

Explore our great checking accounts with tools to help you manage your

financial life.