Payment Control applies to certain individual checks, and payments made using your routing and checking account numbers (ACH transactions). Debit card transactions do not qualify for Payment Control. When you choose to return an item that has been presented to PNC for payment, we will return the item to the payee’s bank for insufficient funds, and the payee will not receive payment from PNC. You may still have an obligation to pay the payee for goods, services or other products. PNC is not responsible for satisfying any obligations between you and the payee or any other party with respect to an item you decide to return. Before choosing to return an item, you should consider rules the payee may have or actions the payee may take on late/returned payments. Overdrawing an account, maintaining a negative available balance for any period of time, and returning transactions as unpaid may have other consequences, including account closure or negative impacts to your ability to obtain financial services including loans, deposit accounts, and other services at PNC and other institutions.

Overdraft Solutions

People can have low cash moments, so the occasional overdraft can happen. That's where PNC Overdraft Solutions come in.

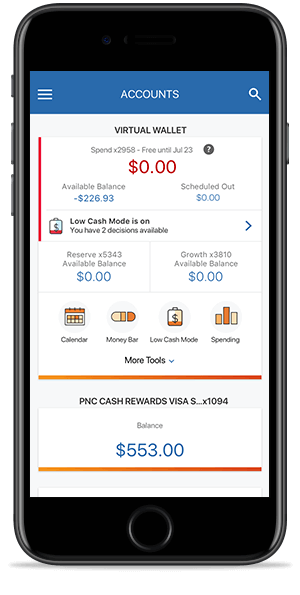

Low Cash Mode®

A set of features, including mobile banking tools, to help you avoid overdraft fees.

Your Virtual Wallet Spend account comes with Low Cash Mode, which delivers real-time intelligent alerts that let you know when your balance is low, allows you to choose whether certain transactions[1] should be paid or returned when your balance is negative, and gives you at least 24 hours to bring your account out of the negative so you can avoid overdraft fees.

- Extra Time – you’ll have at least 24 hours to bring your available Spend account[2] balance to at least $0[3] before you are charged overdraft fees.

- Payment Control – you can choose to pay or return certain individual checks, and payments made using your routing and checking account numbers (ACH transactions),[1] when your balance is negative.

- Intelligent Alerts – a suite of alerts so you know when to and how long you have to take action.[4]

PNC Overdraft Solutions

Learn about your options and decide which are right for you.

Overdraft Protection

Link up to two of your PNC accounts to help protect your PNC checking account from overdrafts.[5]

Set up Overdraft Protection to link your checking account with up to two other eligible PNC accounts (called your Protecting Accounts) so that you can use available funds to cover overdrafts. You can link:

- A secondary PNC checking account

- A PNC savings account or money market deposit account[6]

- Any PNC credit card

- A PNC line of credit[7]

When there's an insufficient available balance in your checking account to pay for any item, funds, if available, are transferred from the protecting account to cover your purchases.

If you have a Virtual Wallet product with Spend, Reserve and Growth, you do not need to sign up for Overdraft Protection. With Virtual Wallet, if you overdraw your Spend account, PNC will transfer available funds from your Reserve and/or Growth accounts to cover your transaction.[5]

Please note that Overdraft Protection is not available for your Reserve and Growth accounts. If you have a Virtual Wallet product with a Spend only, you can set up Overdraft Protection.

Overdraft Coverage

Opting in to Overdraft Coverage allows PNC to cover your ATM and everyday (one-time) debit card transactions when your available balance is not enough to cover the transaction(s).

When you opt in, PNC may pay your ATM and everyday (one-time) transactions, at our discretion. Overdraft fees apply.

When you opt out, ATM and everyday (one-time) debit card transactions will be declined if your available balance is too low.

Overdraft Coverage does not apply to checks, ACH and recurring debit card transactions. PNC may pay these at our discretion.

You can choose Overdraft Coverage for each PNC checking account you have, and you can opt in or out of Overdraft Coverage whenever you like.

Please note that Overdraft Coverage is not offered on PNC Simple Checking or Virtual Wallet Reserve and Growth accounts.

For additional details:

Overdraft Notification

Overdraft fees may apply - See Consumer Schedule of Service Charges and Fees and/or PNC Virtual Wallet Features and Fees

Digital Banking Tools

In addition to the Overdraft Solutions above, PNC offers a number of ways to help make your financial life easier.

Direct Deposit

With this service, you can access your money the same day you’re paid, which may give you faster access to funds than a check deposit.

Mobile Banking

Check your balance, pay bills, request help, and more. The PNC Mobile app lets you access your transactions and current available balance on the go, so you can stay informed if your balance is low.[9]

Frequently Asked Questions

You may be charged a fee each time we pay an item, with daily limits depending on your account type. See Consumer Schedule of Service Charges and Fees and/or PNC Virtual Wallet Features and Fees

Yes. PNC Simple Checking does not charge overdraft fees. It is Bank On certified as a low cost, no overdraft fee bank account.

No consumer accounts charge a non- sufficient funds (NSF) fee.

People make mistakes, so the occasional overdraft can happen. If it happens, opting in may allow your ATM withdrawals and everyday (one-time) debit card purchases to be approved, which saves you the embarrassment of being declined and/or leaving you in a position where you may be unable to complete the transaction.

No, Overdraft Coverage only applies to ATM and everyday (one-time) debit card transactions. Items such as checks, ACH transactions (paid using your account and routing number, like a utility bill) and recurring debit card transactions (like a gym or subscription box payment) are treated under the bank's standard overdraft practices. In the case when you do not have sufficient available funds to cover these types of items, the bank, at its discretion, may pay the item(s) resulting in an overdraft fee(s).

No, the bank has the discretion to approve or decline a transaction that causes the account to become overdrawn.

Yes, Overdraft Protection links your checking account to another eligible PNC account, so you can use available funds to cover overdrafts. However, if there are not enough available funds in your Protecting Account to cover your ATM and everyday (one-time) debit card transactions, they will be declined. Opting in to Overdraft Coverage could provide an additional layer of coverage for ATM and everyday (one-time) debit card transactions in the event you exhaust your Overdraft Protection funds.

Overdraft Coverage does not affect the way we process overdrafts on recurring debit card transactions, checks and other transactions made using your checking account. We will continue to exercise our discretion in paying these overdrafts.

Your ATM and everyday (one-time) debit card transactions will be declined in the event of an overdraft, unless you have PNC Overdraft Protection and available funds. Our standard overdraft practices will continue to be in effect for your checks and automatic bank payments.

You or any joint owner may change your opt-in or opt-out choice at any time.

- Call 1-877-588-3605 and select Option 1

- Visit any branch

- In Online Banking:

- Sign on to PNC Online Banking, select the Profile icon and then select Overdraft Solutions. Your eligible accounts will be listed and you can choose to enroll in Overdraft Protection or opt in or out of Overdraft Coverage.

- In the PNC Mobile app:

- Select the Menu, then Profile & Settings. Select Overdraft Solutions from the Account Preferences section. First time users will need to select Enroll Account and complete the wizard to select an account and the type of protection.

- To enroll additional accounts, select Enroll More Accounts, Choose to Opt In or Out of Overdraft Coverage.

International customers may call us at 412-803-7711 (personal accounts) or 412-803-0141 (business accounts).

For Our Deaf and Hard of Hearing Customers, PNC accepts Telecommunications Relay Service (TRS) calls.

The bank will process the last selection received as of 10:00 p.m. ET (before posting) each business day. Therefore, in the example above, the last opt-out choice would be applied to the account the next business day.

Only one authorized signer per account has to opt in for Overdraft Coverage.

Yes, you do have the option to add Overdraft Coverage to the Spend account in your Virtual Wallet. Opting in to Overdraft Coverage would provide you with an additional layer of coverage for your ATM and everyday (one-time) debit card transactions on your Spend account in the event you exhaust all of your Overdraft Protection funds. If you do not opt in, your ATM and everyday (one-time) debit card transactions will be declined if you do not have sufficient funds in your linked overdraft protection accounts. Overdraft Coverage is available on the Spend account only.

No, consumer accounts can not be used to protect a business account and business accounts cannot be used to protect a consumer account.

For more information about business accounts and Overdraft/NSF fees, see Business Checking Accounts and Related Charges.

Insights

Spend

What Is an Overdraft Fee?

Overdraft fees can be a costly, unplanned expense. PNC Bank has a quick guide to help you understand what overdraft fees are and how you can avoid them.

4 min read

Spend

Understanding Overdraft Coverage & Protection

Find out more about these overdraft solution services.

2 min read

Spend

The Pros and Cons of Overdraft Coverage

Overdraft coverage can be helpful in certain circumstances, but costly if not used properly. Could it be right for you?

1 min read

Contact Us

Have Questions or Need Help?

Call Us

Automated account

information is available 24/7.

Visit Us

Find a PNC location near

you and stop by to see us.