PNC Mobile Accept is a method of accepting credit card payments and is available through PNC Mobile Banking. Payment processing services through PNC Mobile Accept are provided by Tempus Technologies, Inc. (a wholly owned subsidiary of PNC Bank, N.A.) and subject to application, credit review of the business and its owners, and approval. Use of PNC Mobile Accept requires (1) an eligible and active business checking account and agreement with PNC Bank, N.A. (2) an approved and active payment processing account and agreement with Tempus Technologies, Inc., and (3) the PNC mobile banking application be downloaded and installed on a supported device. Certain other restrictions may apply.

PNC Mobile Accept® Portable Card Reader

Simple & Affordable Payment Processing for Your Small Business

PNC Mobile Accept requires an active PNC business checking account.

Get Paid & Pay as You Go

Who's It For

Mobile Accept is best for these kinds of in-person businesses.

Please inquire about which industries are suitable for this product, as they may change over time.

- Appointment-based businesses like barbers, hair stylists, salons & spas

- Mobile businesses like food trucks, landscapers, or pet groomers

- Seasonal businesses like ice cream shops, nurseries & holiday stores

- Crafters like quilters, potters, & jewelers

- Farmers’ market vendors & artisans

- Kiosks, pop-ups & mobile vendors

Payment processing solutions for other kinds of businesses and industries, including those with card-not-present sales or larger transaction volumes, are offered through PNC Merchant Services Company.

Who's Eligible

Your small business should meet these requirements to be eligible:

Card Payment Processing Activity:

- Under $300,000 per year in card transactions

- Average transaction size under $1,000

- In-person card present transactions to collect payment at time products or services are provided

Payment processing solutions for other kinds of businesses and industries, including those with card-not-present sales or larger transaction volumes, are offered through PNC Merchant Services Company.

How It Works

Full-service card processing means you can:

- Accept Visa®, Mastercard®, Discover®, American Express® and more – right from your phone or tablet with the PNC Mobile app.

- Take cards by dip, tap and swipe, or even manually enter card information in the PNC Mobile app.

- Enable tax and tip functionality easily

Note that debit cards must be Visa or Mastercard branded – PIN and signature entry are not available.

Card Reader

Secure magnetic stripe and EMV® contact chip reader (Swipe/Dip/Tap)

$49 plus tax with PNC Mobile Accept account

Includes Shipping

- Bluetooth® connectivity

- Card data protection, transaction security and convenience needed to help secure mobile applications with strong encryption and proven authentication

- Ergonomic design simplifies card swiping

- Over 1,000 card swipes between charges

Transaction Pricing

Swipe/Dip/Tap and Manual Non-Swipe transaction prices do not include equipment costs, chargeback fees, app fees and other fees. Equipment and transaction pricing may be subject to change at any time.

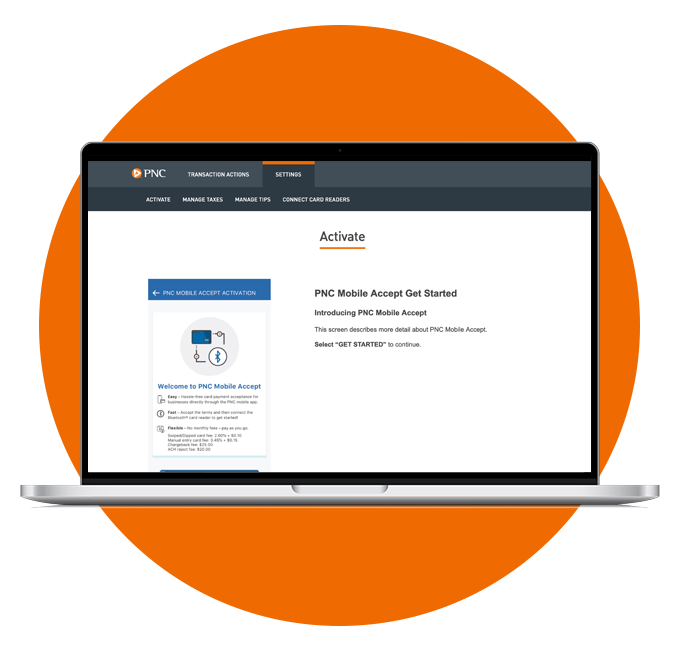

Apply & Activate

Easy as 1 - 2 - 3

Mobile device software requirements:

iPhone® or iPad® mobile digital devices: iOS® 14.0 or higher

Android® mobile device: Marshmallow SDK Version 23 or higher

Explore PNC Mobile Accept for Customer Card Payments

Our Tutorials Include Features & How-to Instructions

Learn more from our Visual Step-by-Step Activation and Usage Tutorials.

Browse additional How-to FAQs plus customer support topics.

Frequently Asked Questions

You may find answers to your questions and concerns in our Frequently Asked Questions.

A portable device that allows businesses to accept payments on the go, that is compact and wireless, connecting via Bluetooth or Wi-Fi that supports tap, dip or swipe transactions.

- Swipe:This involves sliding the card through magnetic-stripe reader on the card reader

- Tap:This involves brining the card or digital wallet close to the card reader, or “tapping” it with the card, using contactless technology to transfer payment information wirelessly.

- Dip:This means inserting the card into the card reader.

No monthly fees: Pay for your card reader and a flat fee per transaction. Other per occurrence fees apply.

Card reader: $49 + tax

Swiped/tapped/dip card fee: 2.60% + $.10

Manual entry card fee: 3.45% + $.15

Typically within two business days with a PNC business checking account.[4]

Visa, Mastercard, Discover and American Express.

Fully integrated safety and security features. Cardholder data is fully encrypted to help protect against fraud.