PNC Easy Lock is not a replacement for reporting your credit card lost or stolen. If you believe your credit card has been lost or stolen, please contact PNC immediately at 1- 888-PNC-BANK and continue to monitor your account activity for unauthorized transactions.

Online Banking

Resource Center

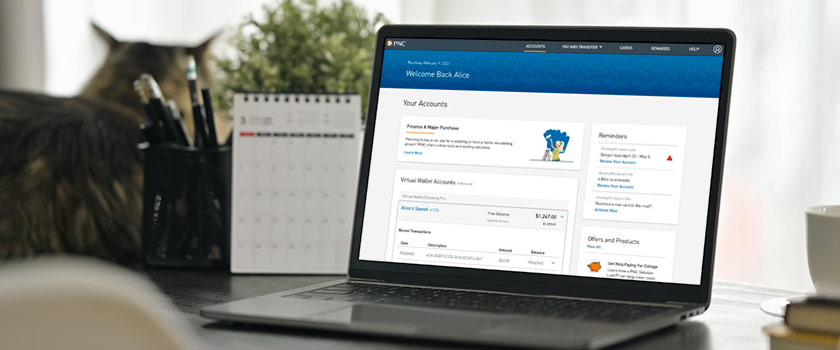

Convenient access to your online banking features, with a new modern look.

Online Banking

Resource Center

Convenient access to your online banking features, with a new modern look.

What You Need to Know

We are enhancing your Online Banking experience.

When you sign on to the new Online Banking (OLB) for the first time, you will see that your tools and features are organized in a new and convenient way.

Digital Banking Tutorials

These step-by-step, self-guided walkthroughs give you a preview on how to perform common tasks on your computer through the enhanced Online Banking experience.

If you have small business accounts, view our business digital banking tutorials.

PNC Wealth Management or PNC Private Bank customers, view our investments digital banking tutorials.

Same Great Features

It’s a new look & experience, with continued access to the tools and features you need to bank when you want, where you want.

General Online Banking FAQs

General Questions & How To Complete Certain Transactions

in the New Online Banking

No, you won’t be able to use the old version once you switch over to the enhanced Online Banking experience.

To get answers or help, visit the Help Center and select Message PNC to message with a Care Center consultant.

In the Help Center, you can also:

- Contact PNC by phone or schedule an appointment at a branch

- Find links to common tasks, like stopping payments or disputing transactions

- Take a tour to learn about the new Online Banking

Your PNC Mobile app will stay the same with all the tools and features you use today.

Ensure your PNC Mobile app is updated to the latest app version for your mobile device for optimal experience.

After you sign on, you can use the Online Banking Help Center to contact us.

- Go to pnc.com and select Sign On.

- Select Forgot ID or Password.

- Verify your information and choose how to receive a one-time passcode.

- Verify the one-time passcode you receive.

- Your user ID will appear on the next screen.

- If you also need to reset your password, complete the request and select Reset Password.

We no longer can store the same number of phone numbers and e-mail addresses in your customer profile. The maximum is now five of each.

To ensure your contact information is correct, follow the steps to update your emails and update your phone numbers.

Here’s what you can do:

In the new PNC Online Banking experience, complete these steps if you need to set up a new User ID and password for the beneficiary:

- Sign on to PNC Online Banking.

- From the Your Accounts page, select the S is for Savings account.

- Select Account Actions.

- Under Child’s Profile Settings, select Modify Sign On.

- Verify your identity with a one-time passcode.

- Add a child phone number if applicable, and/or select Next.

- Select Add to create a User ID and then a password, then select Next.

Complete these steps if you need to review the Additional Sign On Security option:

- Sign on to PNC Online Banking.

- From the Your Accounts page, select the S is for Savings account.

- Select Account Actions.

- Under Child’s Profile Settings, select Additional Sign On Security.

- Verify your identity with a one-time passcode.

- Set the Additional Sign On Security to your preference.

If you have questions or need assistance call us at 1-888-PNC-BANK (1-888-762-2265) and choose the Online Banking option.

- Sign on to Online Banking.

- Select Pay and Transfer, and then Transfers.

- Select Make a PNC Transfer or Make an External Transfer.

- Enter the transfer details.

- Review and submit your transfer.

Note: If you have not had any external transfer activity in the past 365 days, you will need to re-enroll by navigating to External Transfers and re-adding your external accounts.

- Sign on to Online Banking.

- Select Pay and Transfer, and then Wires and International Transfers.

- Choose Send a Domestic Wire or Make an International Transfer.

- If this is your first wire transfer within Online Banking, you’ll need to accept the terms and conditions. Fees may apply.

- Enter your recipient’s information and transfer details, and then select Submit. Ensure your recipient is a person you know and trust.

- Verify your identity to complete the transfer.

Sign on to Online Banking and select your account from the Accounts page.

- Select Transactions to view up to 24 months of transactions.

- Select Statements and Documents for up to seven years of statement history.

The way that you receive Notifications and Alerts is managed from your Online Banking Profile within Alerts and Communication.

To ensure you are receiving emails as you would expect, all account owners, including joint owners, should confirm or update the email address(es) on file. Once signed on to Online Banking, navigate to the Profile and Settings icon, select the Personal Information tab, and review or make updates to your contact information.

You will need to take action to have Online Bill Pay available to you in the new Online Banking experience. You can call our Bill Pay service provider (Fiserv) at 800‑848‑1337 to reinstate your Online Bill Pay service or for more information on your status.

If you do not take this action, none of your current Bill Pay history or payee information will migrate.

If you have already contacted Fiserv to resolve this issue, there is nothing else you need to do.

Yes, all previously scheduled bill payments and transfers will be processed as instructed.[1] This applies to both recurring transactions and one-time transactions.

Note: The Transfer Funds tab will no longer be available to make payments. Instead, chose any of these simple options:

From the Accounts Home Page:

- Select the green Make a Payment button next to the account for which you'd like to make a payment.

Within the Loan Account:

- Select the green Make a Payment button next to the account for which you'd like to make a payment.

From the Pay and Transfer Menu:

- Select Make a Payment.

- Select the green Make a Payment button next to the account for which you'd like to make a payment.

For all options, follow the steps to enter the payment details and submit.

- From the Accounts Home page, select the Line of Credit or Credit account.

- Select Request Advance.

- Enter the Advance details and submit.

- From the Pay and Transfer menu, select PNC Payments.

- Select Manage External Accounts.

- Select Add External Account.

- Enter the external account details.

Specialized FAQs

How to Complete Small Business, PNC Wealth Management, and PNC Private Bank Tasks in the New Online Banking

Small Business FAQs

Difficulties with delegates logging in to your updated Online Banking experience? Follow these steps to learn more

Your business accounts won’t be impacted. All scheduled bill payments and transfers will be processed.[1]

Cash Flow Insight is the suite of cash flow tools included in Online Banking for businesses.

Previously these tools were included in a paid subscription, but are now free and available with eligible business checking accounts enrolled in Online and Mobile Banking.

If you used Cash Flow Insight in the old Online Banking, you’ll notice some of these tools were renamed in connection with their enhancements in the new Online Banking:

- Cash In and Cash Out are now one tool: Pay and Get Paid

- Spend Analysis is now Expense and Income Reports

When you have a personal account with PNC, account linking to a business account in the new Online Banking is done through the personal user ID.

To link business accounts to your personal user ID in Online Banking:

- Sign on to Online Banking with the user ID for your personal account.

- Select Profile and Settings menu, and then Security and Access.

- Select Account Linking and follow the steps from there.

To link accounts from two business user IDs in Online Banking:

- Sign on to Online Banking with the business user ID you want to link to. This is the user ID you want to use to access your linked accounts.

- Select Profile and Settings menu, and then Security and Access.

- Select Account Linking and follow the steps from there.

Delegates should sign on using their established credentials (user ID starting with $). Delegates will then need to re-enroll in Online Banking by providing personal information such as their date of birth and Social Security number.

As part of the re-enrollment steps, delegates will need to create a new user ID and password.

To enhance the security of your personal accounts, delegates will lose access to the personal accounts to which they previously had access. You won’t be able to grant access to these accounts in the future.

For delegates that can’t sign on to Online Banking, the account owner or controlling party will need to create the delegate again in the new Online Banking.

- Upon creating a delegate in the new Online Banking, the account owner will receive an invitation code that they will need to provide to the delegate.

- The delegate will receive an invitation email with instructions for how to set up their user ID and password.

- The invitation code, which expires after 7 days, is required for the delegate to complete Online Banking enrollment.

Pay Receive Sync is the new “Payables, Receivables and Accounting Software Sync” (also previously known as “Invoices Bills Sync”). It’s a fee-based platform hosted by BILL.com that provides businesses with tools for their accounts payable and receivable. Businesses can also connect (“sync”) data from their favorite accounting software to Pay Receive Sync for more efficiency in their business finances.

Pay Receive Sync can be found in the Business Payments section of the new Online Banking.

PNC Wealth Management

You will need to accept the digital banking agreements terms and conditions. The “Total Insight” link will be no longer be available, and you can choose to view your entire investment relationship or go directly to a particular investment account.

The new site is streamlined with a consistent layout throughout. Recent transactions, helpful tools and frequently used links are centrally located. Additionally, we have enhanced the research and online trading tools.

When you first sign on to execute a trade, you will be prompted to accept updated terms and conditions. Once accepted, you will find the trading functionality located throughout the site to make executing buys and sells easier.

Additionally, quote lookup will allow you to research by symbol or name, and real-time quotes will now be standard.

All existing periodic investment plans will migrate in their entirety to the new site without interruption.

You can see other investment accounts or share your investment account information using the Delegation functionality.

If you currently have an Interested Party designation on your accounts, this functionality will migrate automatically to the new platform without interruption.

Yes. All existing external accounts and any manual accounts added to Net Worth will migrate to the new site without interruption.

Yes. All performance information, including history, will continue uninterrupted on the new site.

Investment statements and documents will be included with other account documents on the Alerts and Communication page.

You will be able to access the Statement and Documents page two ways:

- Via the Investments experience (Statements and Documents tab)

- Via the Profile/Settings page

You will be able to filter by date, document type and account type to monitor your investments easier.

When the new Online Banking becomes available, interested parties should sign on using their established credentials (user ID starting with $). Interested parties will then need to re-enroll in Online Banking and create a new user ID and password.

PNC Private Bank FAQs

As a PNC Private Bank® client, you should contact your dedicated Private Bank team or the Premium Care Center with any questions. They will serve as your primary points of contact and are here to support and guide you throughout your migration.

There are also additional General FAQs that may be helpful to you.

While the overall functionality remains consistent, the look and feel may vary slightly from the visuals you have seen in communications or on the Online Banking Resource Page. There is no need for concern.

Depending on your relationship, certain branding elements (i.e. logo and colors) may be customized to create a more personalized experience.

When you have a personal account with PNC, account linking to a business account in the new Online Banking is done through the personal user ID.

To link business accounts to your personal user ID in Online Banking:

- Sign on to Online Banking with the user ID for your personal account.

- Select Profile and Settings menu, and then Security and Access.

- Select Account Linking and follow the steps from there.

To link accounts from two business user IDs in Online Banking:

- Sign on to Online Banking with the business user ID you want to link to. This is the user ID you want to use to access your linked accounts.

- Select Profile and Settings menu, and then Security and Access.

- Select Account Linking and follow the steps from there.

Interested parties should log in using their established credentials (user ID starting with $). Interested parties will then need to re-enroll in Online Banking by providing personal information such as their date of birth and Social Security number.

As part of the re-enrollment steps, interested parties will need to create a new user ID and password.

For interested parties that can’t sign on to Online Banking, the account owner or controlling party will need to create the interested party again in new Online Banking.

To view and manage interested parties in Online Banking:

- Sign on to Online Banking with the user ID for your personal account.

- Select Profile and Settings menu, and then Security and Access.

- Select Delegates and follow the steps from there.

- Upon creating an interested party in the new Online Banking, the account owner will receive an invitation code that they will need to provide to the interested party.

- The interested party will receive an invitation email with instructions for how to set up their user ID and password.

- The invitation code, which expires after 7 days, is required for the interested party to complete Online Banking enrollment.