Qualifying direct deposit is defined as a recurring Direct Deposit of a paycheck, pension, Social Security, or other regular income electronically deposited by an employer or an outside agency. Credit card cash advance transfers, wire transfers, person-to-person transfers, transfers from one account to another, or deposits made at a branch, ATM, mobile device, or through the mail do not qualify as qualifying direct deposits.

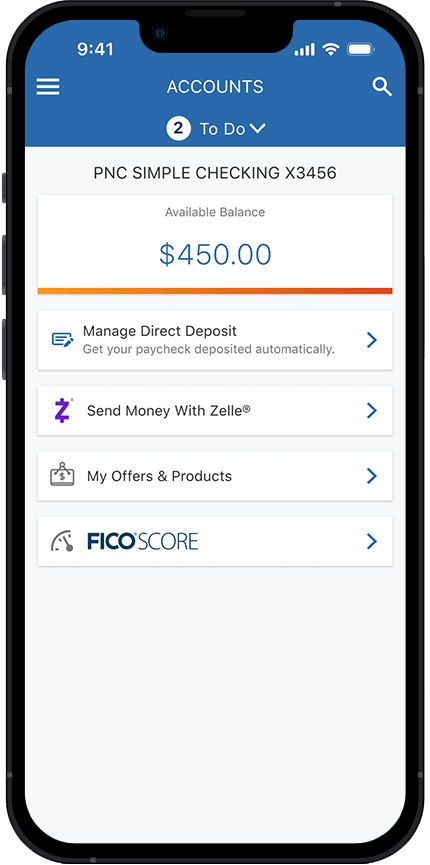

PNC Simple Checking

Hassle-free banking with fewer fees

Brilliant Benefits, Wherever Life Takes You

Coast to coast branch and ATM network[3]

Cardless access at PNC ATMs

Transfer easily between your PNC accounts

Choose a debit card design that matches your style

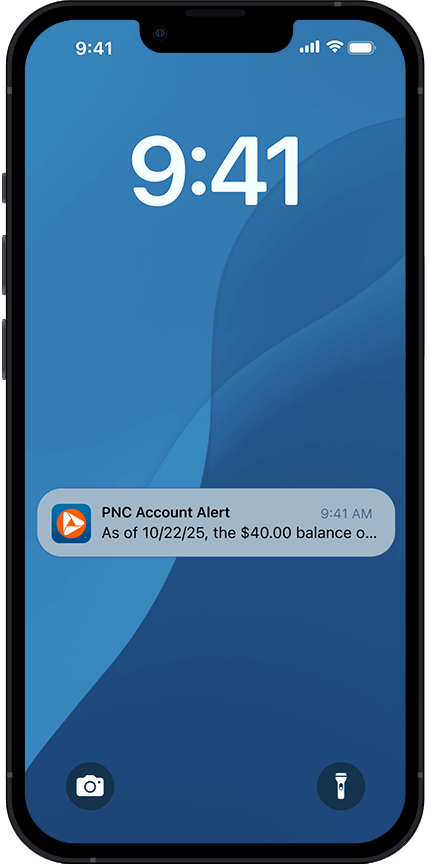

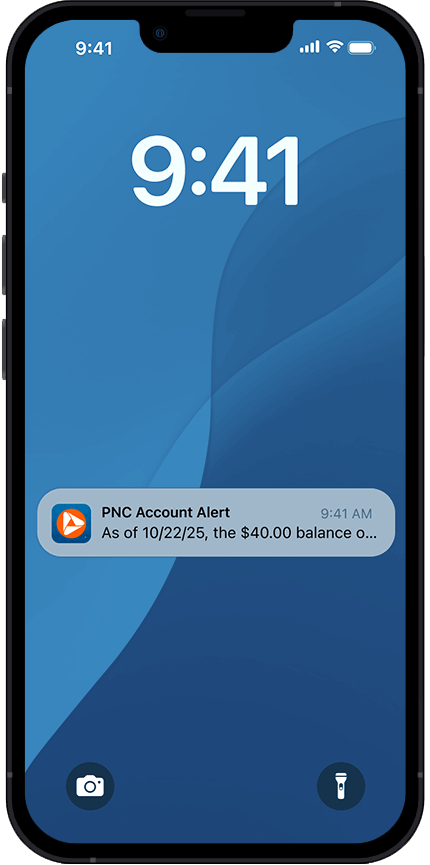

Monitor Your Money with Alerts

Stay on top of your money with customizable alerts.[5]

- Customize your notifications for account transactions

- Get daily balance updates

- Receive notifications of any suspicious account activity

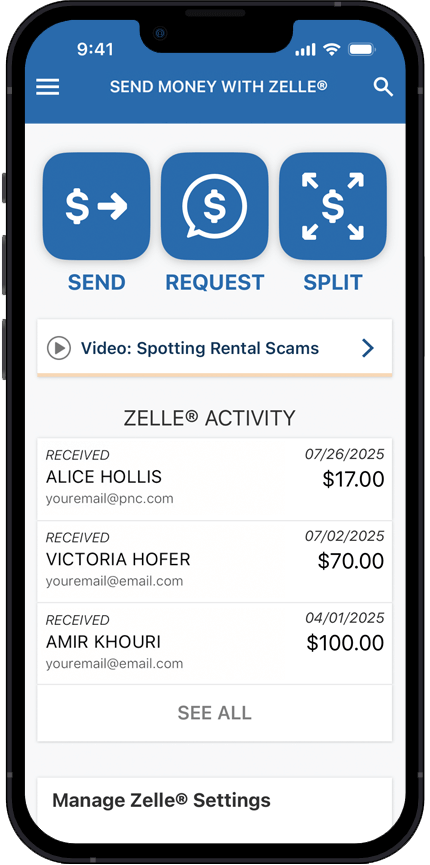

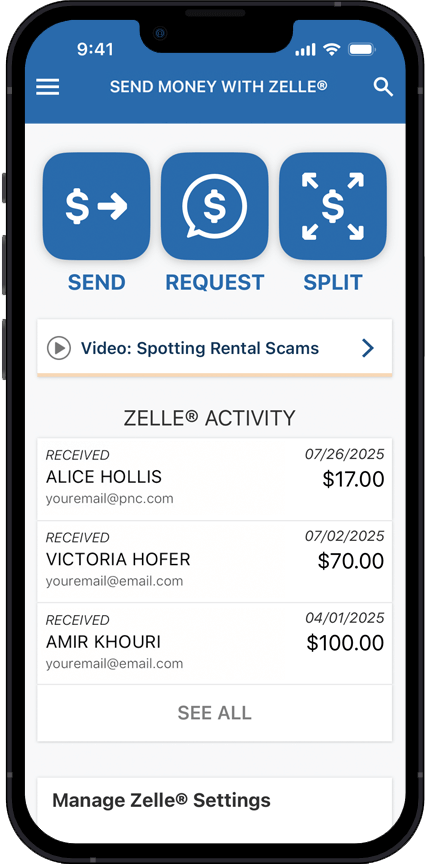

Send Money to People You Know & Trust with Zelle[6]

Zelle® is easy to use in the PNC Mobile app and is directly connected to your account.

- Send and receive money with people you know and trust

- Have funds deposited directly into your account for use

- Easily split expenses when you are out with friends and family

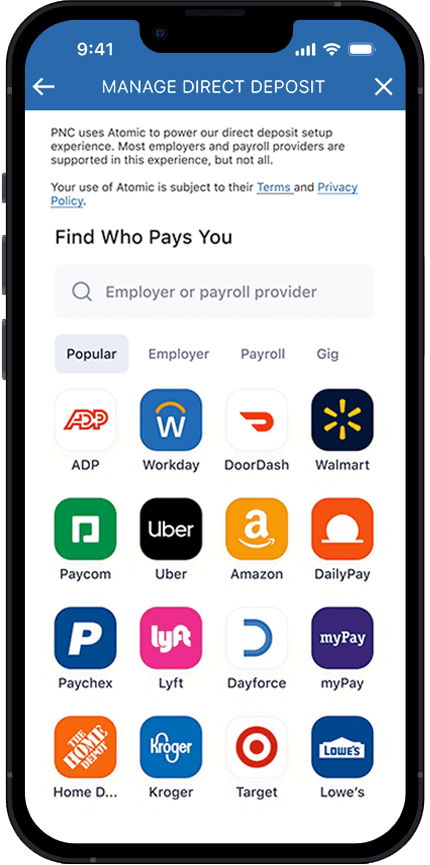

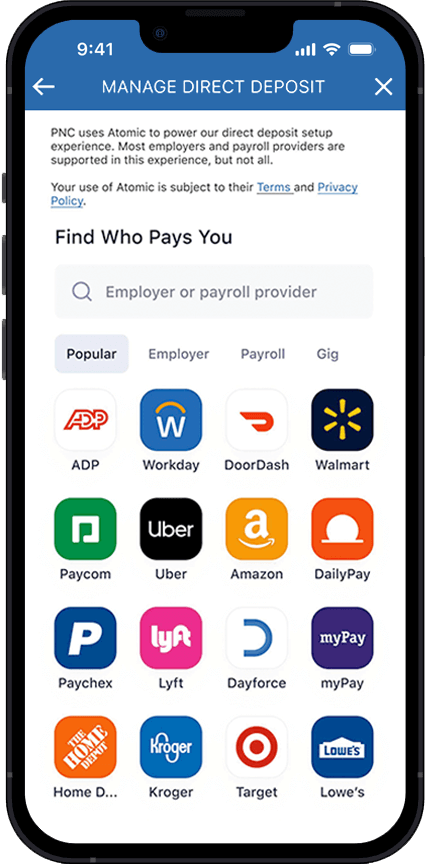

Digitally Switch Your Banking Easily to Get Started

Transfer your direct deposit and more.

- Switch your direct deposit to PNC in the mobile app

- Use mobile check deposit for any paper checks

- Set up and automatically pay your bills

- Mobile App

- Alerts

- Zelle

- Digital Budgeting

Do More with the PNC Mobile App

Monitor Your Money with Alerts

Send Money to People You Know & Trust with Zelle®

Digitally Switch Your Banking Easily to Get Started

Transfer your direct deposit and more.

- Mobile App

- Alerts

- Zelle

- Digital Budgeting

Brilliant Money Moves

for Life's First Steps

Are you under 25? Enjoy PNC Simple Checking and add a Standard Savings account with no monthly service charge when you bank with PNC.[2]

Account Details

Low fees for all your everyday banking needs

PNC Simple Checking has guardrails to help prevent overspending

If your balance isn’t enough, we simply decline the charge and won’t charge you an overdraft fee

There are situations where your account may still become overdrawn. For example, gas stations often pre-authorize a set amount before they know the total, which might be less than what you actually spend. If you spend more than what's available in your account, because the transaction is already authorized, your account will become overdrawn. You still won't be charged a fee in these cases.

Get a second chance at banking with low fees that fit your everyday needs.

As a Bank On certified account, PNC Simple Checking is recognized for meeting national standards for safe, affordable, and accessible banking—including for those who need a second chance.

Frequently Asked Questions

A qualifying direct deposit is defined as a recurring direct deposit of a paycheck, pension, Social Security or other regular income electronically deposited by an employer or an outside agency.

Credit card cash advance transfers, wire transfers, person-to-person transfers, transfers from one account to another, or deposits made at a branch, ATM, mobile device or through the mail do not qualify as qualifying direct deposits.

In most cases, we simply decline the charge and won’t charge you an overdraft fee. There are situations where your account may still become overdrawn. For example, gas stations often pre-authorize a set amount before they know the total, which might be less than what you actually spend. If you spend more than what's available in your account, because the transaction is already authorized, your account will become overdrawn. You still won't be charged a fee in these cases.

After you turn 25, the $5 monthly service charge will be assessed unless you meet one of the other requirements to avoid this charge. Setting up a qualifying direct deposit into this account will ensure you avoid this charge, regardless of your age.

PNC Simple Checking is available to individuals who meet standard banking requirements, such as providing valid identification and required personal information. The account is especially designed for those seeking straightforward banking with low fees, including customers under 25, 62 or over, or anyone who prefers simple, hassle-free checking.

The PNC Simple Checking account has a $5 monthly service charge. However, you can avoid this fee if you set up any qualifying direct deposit, or if you are under 25 or 62 years of age or older. There are no overdraft fees, no minimum balance requirements, and no hidden charges—making it a transparent and affordable option for everyday banking.

PNC reviews standard banking history reports, such as EWS, as part of the account opening process. If you have a negative banking history, it may impact your eligibility. However, PNC Simple Checking is Bank On certified, meaning it is designed to be accessible – even if you’ve had banking challenges in the past, this account can be a fresh start for those seeking a second chance at safe and affordable banking.

Once your PNC Simple Checking account is open and funded, you can start using your account right away through online and mobile banking. Your debit card will typically be mailed to you soon after account opening, and you may also have access to a digital card in the PNC Mobile app for immediate use.

PNC Simple Checking offers:

- No overdraft fees and no minimum deposit to open online

- Access to PNC’s nationwide branch and ATM network

- Cardless access at PNC ATMs and a choice of debit card designs

- Easy transfers between PNC accounts[7]

- Powerful mobile app features, including customizable alerts, Zelle®[6] for sending and receiving money with people you know and trust, mobile check deposit, and direct deposit switching

- Bank On certification for safe, affordable banking

From teens and students to retirees, PNC Simple Checking is designed to fit your lifestyle—simple and hassle-free. It’s a great fit for first-time account holders, students, seniors, and those looking for a second chance checking account to build positive banking history. Whether you’re just starting out, getting back on track, or simply want straightforward everyday banking, PNC Simple Checking helps make managing your money simple and accessible.