See our Business Checking Accounts and Related Charges disclosure for further information.

Business Checking Plus

For businesses that handle a high volume of transactions.

Features & Benefits

Get more transactions plus tools to help you manage cash flow.

- No charge for up to 500 transactions per month based on the combined volume of deposits, deposited items, paid items, and ACH credits and debits received.[1]

- $10,000 cash deposited per month over-the-counter, at the night depository or via Quick Deposit at no charge.[2]

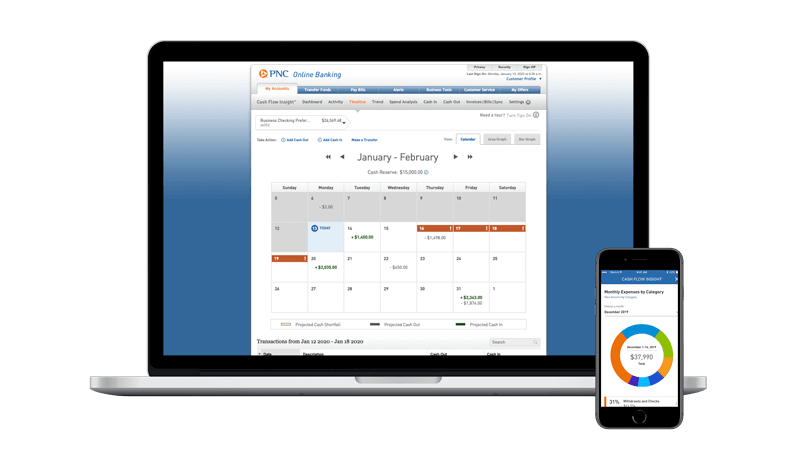

- Cash Flow Insight®[3]: Spend Analysis, Timeline, Trend, Cash In, Cash Out – tools and insights to operate your business confidently.

- No charge for Online Statements, or get Paper Statements for a small fee.

- No ATM transaction fees at PNC Bank ATMs.

- Free Visa® Business Debit Card.

- No set-up fee for Overdraft Protection.

- Earn cash with PNC Purchase Payback®[4] for making everyday purchases.

- Free Online Banking[5] and Bill Pay.[6]

- Virtual Wallet® with Performance Select – a personal checking account with no monthly service charge for business owners.[7]

- Use our Quick Switch Kit to help you complete your transfer of checking related services to PNC Bank.

Waive the Monthly Fee

4 options to avoid the Monthly Account Maintenance Fee

$22 or $0 Monthly Account Maintenance Fee

Waive fee if you meet ONE of the requirements:

- Maintain a $5,000 average collected monthly balance, OR

- $5,000 or more in purchases on a linked PNC business credit card, [8,9,10] OR

- $5,000 or more in eligible linked Merchant Account deposits monthly [9,11,12,13] OR

- Maintain a $20,000 average balance in a linked PNC business checking account and business money market account [9]

Cash Flow Solutions

Take control over what’s in, what’s out and what’s possible for your business.

Improve Payment Practices & Accelerate Receivables

- Cash Flow Insight® – Payables: Approve, pay, schedule and archive bills faster and more efficiently. Create placeholder payables, make payments to vendors electronically.[14]

- Cash Flow Insight® – Receivables: Create branded invoices online. Track the money you expect to receive (including new and placeholder transactions), view payment activity and schedule reminders.[14]

- Cash Flow Insight® – Accounting Software Sync: Save time by syncing vendor, customer, bill, invoice and payment information between Cash Flow Insight and your accounting software like QuickBooks®, Xero®, Intacct®, NetSuite® and more.[14,15]

- PNC Bank Visa® Business Debit Card: Save money when you reduce the number of checks you need to buy and write.

- Visa® Business Credit Card[10]: No Annual Fee. Use your card to make payments and better track your expenses.

- PNC Merchant Services®[12]: Next business day funding on payment processing transactions when deposited to your PNC business checking account.[13]

How to Apply

Open your account online, by phone or at a branch.

- Ways to Apply

- What You Need to Apply Online

- What You Need to Apply at Branch

Use our Quick Switch Kit to help you complete your transfer of checking related services to PNC Bank.

Choose Your Business Entity Type

Determine which documents you may need to provide to verify your business registration and your authority to act on behalf of the business:

- SSN of owner who will sign on the account

- Fictitious Name Registration, also known as Trade Name Registration, Certificate of Assumed Name, Registration of Alternate Name, or Assumed Name Registration

- SSN of partners who will sign on the account

- Partnership Agreement

- Fictitious Name Registration, also known as Trade Name Registration, Certificate of Assumed Name, Registration of Alternate Name, or Assumed Name Registration

- Information regarding the individual Beneficial Owners of the business. Beneficial Owners are those who own, directly or indirectly, 25% or more of the equity interests of the business. This information is collected to help fight financial crime.

- Legal name, Social Security Number, Date of Birth, Address, Citizenship, Percent of Ownership

- SSN of members, managers or partners who will sign on account

- Operating Agreement

- An Operating Agreement may not be necessary if it isn’t required by the state. Additional supporting documentation may be requested for account opening.

- Limited Partnership Agreement (LLP only)

- Certification of Formation/Organization (LLC) or Certificate of Limited Partnership (LLP)

- Fictitious Name Registration, also known as Trade Name Registration, Certificate of Assumed Name, Registration of Alternate Name, or Assumed Name Registration

- Information regarding the individual Beneficial Owners of the business. Beneficial Owners are those who own, directly or indirectly, 25% or more of the equity interests of the business. This information is collected to help fight financial crime.

- Legal name, Social Security Number, Date of Birth, Address, Citizenship, Percent of Ownership

- SSN of officers or directors who will sign on account

- By-laws

- Articles of Incorporation and any amendments

- Certification of Formation/Organization

- Board of directors meeting minutes (signed and dated).

- Fictitious Name Registration, also known as Trade Name Registration, Certificate of Assumed Name, Registration of Alternate Name, or Assumed Name Registration

- Information regarding the individual Beneficial Owners of the business. Beneficial Owners are those who own, directly or indirectly, 25% or more of the equity interests of the business. This information is collected to help fight financial crime.

- Legal name, Social Security Number, Date of Birth, Address, Citizenship, Percent of Ownership

- SSN of officers or directors who will sign on the account

- By-laws

- Certification of Formation/Organization

- Board of directors meeting minutes (signed and dated)

- Authorization letter on company letterhead

- Fictitious Name Registration, also known as Trade Name Registration, Certificate of Assumed Name, Registration of Alternate Name, or Assumed Name Registration.

- Information regarding the individual Beneficial Owners of the business. Beneficial Owners are those who own, directly or indirectly, 25% or more of the equity interests of the business. This information is collected to help fight financial crime.

- Legal name, Social Security Number, Date of Birth, Address, Citizenship, Percent of Ownership

- Review the entity type above associated with your Non-Profit Organization to determine which documents to provide (Partnership, LLC, Corporation)

- A 501(c) tax form or state Non-Profit registration may be needed for certain product eligibility

You may also want to review our current Service charges & fees before applying.