The earnings credit rate on Analysis Business Checking or Treasury Enterprise Plan accounts is subject to change without notice. Please call 877-BUS-BNKG (877-287-2654) for current rate and balance tier information or for an example of how the earnings credit is applied to the balances in your account.

Treasury Enterprise Plan

For businesses with higher cash deposit and transaction needs.

Features & Benefits

The Business Banking and Treasury Management package for your Analysis Business Checking account for optimal money management.

Higher Limits

More combined transactions and cash deposited activity without charge.

Avoid Monthly Account

Maintenance Fee

Speak to a PNC Banker to learn more about product features that help avoid the Monthly Account Maintenance Fee.

Treasury Management to Fit

Your Business

Designed to work as part of a suite of PNC tools to best serve your business.

- The Treasury Enterprise Plan is a Business Banking and Treasury Management checking package for Analysis Business Checking accounts.

- Unlimited transactions per month based on the combined volume of deposits, deposited items, paid items, and ACH credits and debits received.

- $50,000 cash deposited per month over-the-counter, at the night depository or via Quick Deposit at no charge.

- The Monthly Account Maintenance Fee will be waived on up to four beneficiary checking accounts. You have the option to add more than four beneficiary accounts for an additional $10.00 Monthly Account Maintenance Fee for each beneficiary account over four. The monthly average collected balance, transaction, and cash deposited volumes are aggregated for the master and all beneficiary accounts to determine Earnings Credit, Master Monthly Account Maintenance Fee, transaction, and cash deposit fee amounts.

- Link multiple PNC Bank business checking accounts together to help consolidate balances, simplify bookkeeping and service charges.

- An earnings credit[1] is applied only to the average monthly collected balances in excess of $125,000 to reduce or offset certain transaction fees.

- Two investment options for excess cash: Premium Business Money Market account or MMDA Sweep with no Monthly Account Maintenance Fee.

- One free incoming Received Wire Transfer per month (Domestic only)

- More online banking options – Free Online Banking[2] and Bill Pay[3]. For a more critical level of account detail, reporting and options, move up to PINACLE®.

- No charge for Online Statements or get Paper Statements for a small fee.

- No ATM transaction fees at PNC Bank ATMs.

- No set-up fee for Overdraft Protection.

- Free PNC Bank Visa® Business Debit Card.

- Earn cash with PNC Purchase Payback®[4] for making everyday purchases.

- Use our Quick Switch Kit to help you complete your transfer of checking related services to PNC Bank.

Not sure if Treasury Enterprise is right for you? Compare features with other PNC business checking accounts.

Waive the Monthly Fee

$50 or $0 Monthly Account Maintenance Fee

Ways to waive: Maintain $30,000 average combined monthly collected balance in all checking accounts within your Treasury Enterprise Plan (including Beneficiary Accounts)

The first three months are on us - There is No Monthly Account Maintenance Fee for the first three statement cycles.

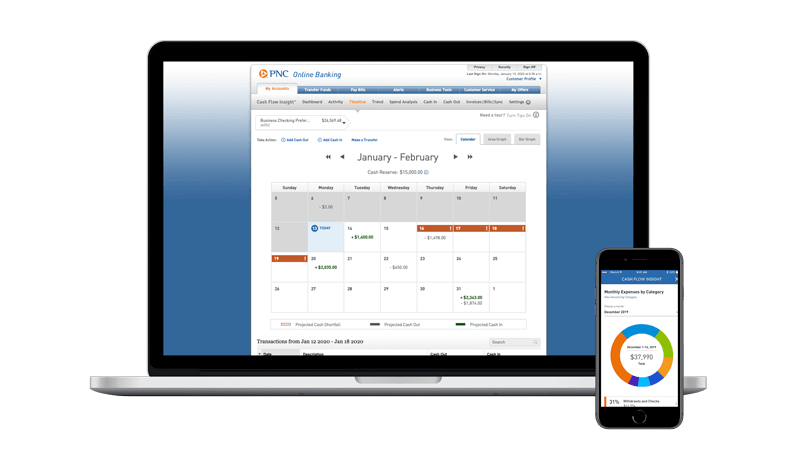

Cash Flow Solutions

Take control over what’s in, what’s out and what’s possible for your business.

Improve Payment Practices & Accelerate Receivables

- Payables: Approve, pay, schedule and archive bills faster and more efficiently. Create placeholder payables, make payments to vendors electronically.[6]

- Receivables: Create branded invoices online. Track the money you expect to receive (including new and placeholder transactions), view payment activity and schedule reminders.[6]

- Accounting Software Sync: Save time by syncing vendor, customer, bill, invoice and payment information between Cash Flow Insight and your accounting software like QuickBooks®, Xero®, Intacct®, NetSuite® and more.[6,7]

- PNC Bank Visa® Business Debit Card: Save money when you reduce the number of checks you need to buy and write.

- Visa® Business Credit Card[8]: No Annual Fee. Use your card to make payments and better track your expenses.

- PNC Merchant Services®[9]: Next business day funding[10] on payment processing transactions when deposited to your PNC Business Checking Plus account.

How to Apply

Open your account online, by phone or at a branch.

- Ways to Apply

- What You Need to Apply Online

- What You Need to Apply at Branch

Use our Quick Switch Kit to help you complete your transfer of checking related services to PNC Bank.

Choose Your Business Entity Type

Determine which documents you may need to provide to verify your business registration and your authority to act on behalf of the business:

- SSN of owner who will sign on the account

- Fictitious Name Registration, also known as Trade Name Registration, Certificate of Assumed Name, Registration of Alternate Name, or Assumed Name Registration

- SSN of partners who will sign on the account

- Partnership Agreement

- Fictitious Name Registration, also known as Trade Name Registration, Certificate of Assumed Name, Registration of Alternate Name, or Assumed Name Registration

- Information regarding the individual Beneficial Owners of the business. Beneficial Owners are those who own, directly or indirectly, 25% or more of the equity interests of the business. This information is collected to help fight financial crime.

- Legal name, Social Security Number, Date of Birth, Address, Citizenship, Percent of Ownership

- SSN of members, managers or partners who will sign on account

- Operating Agreement

- An Operating Agreement may not be necessary if it isn’t required by the state. Additional supporting documentation may be requested for account opening.

- Limited Partnership Agreement (LLP only)

- Certification of Formation/Organization (LLC) or Certificate of Limited Partnership (LLP)

- Fictitious Name Registration, also known as Trade Name Registration, Certificate of Assumed Name, Registration of Alternate Name, or Assumed Name Registration

- Information regarding the individual Beneficial Owners of the business. Beneficial Owners are those who own, directly or indirectly, 25% or more of the equity interests of the business. This information is collected to help fight financial crime.

- Legal name, Social Security Number, Date of Birth, Address, Citizenship, Percent of Ownership

- SSN of officers or directors who will sign on account

- By-laws

- Articles of Incorporation and any amendments

- Certification of Formation/Organization

- Board of directors meeting minutes (signed and dated).

- Fictitious Name Registration, also known as Trade Name Registration, Certificate of Assumed Name, Registration of Alternate Name, or Assumed Name Registration

- Information regarding the individual Beneficial Owners of the business. Beneficial Owners are those who own, directly or indirectly, 25% or more of the equity interests of the business. This information is collected to help fight financial crime.

- Legal name, Social Security Number, Date of Birth, Address, Citizenship, Percent of Ownership

- SSN of officers or directors who will sign on the account

- By-laws

- Certification of Formation/Organization

- Board of directors meeting minutes (signed and dated)

- Authorization letter on company letterhead

- Fictitious Name Registration, also known as Trade Name Registration, Certificate of Assumed Name, Registration of Alternate Name, or Assumed Name Registration.

- Information regarding the individual Beneficial Owners of the business. Beneficial Owners are those who own, directly or indirectly, 25% or more of the equity interests of the business. This information is collected to help fight financial crime.

- Legal name, Social Security Number, Date of Birth, Address, Citizenship, Percent of Ownership

- Review the entity type above associated with your Non-Profit Organization to determine which documents to provide (Partnership, LLC, Corporation)

- A 501(c) tax form or state Non-Profit registration may be needed for certain product eligibility

You may also want to review our current Service charges & fees before applying.