PNC does not charge a fee for Mobile Banking. However, third party message and data rates may apply. These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply. Also, a supported mobile device is needed to use the Mobile Banking App. Mobile Deposit is a feature of PNC Mobile Banking. Use of the Mobile Deposit feature requires a supported camera-equipped device and you must download a PNC mobile banking app. Eligible PNC Bank account and PNC Bank Online Banking required. Certain other restrictions apply. See the mobile banking terms and conditions in the Digital Services Agreement.

Zelle® for Your Business

A Fast and Easy Way to Receive Payments from Customers, Directly to Your Eligible PNC Business Checking Account—

Free in the PNC Mobile App.[1]

Overview

Zelle® is a fast and easy way for eligible businesses to send, receive, and request payments directly between bank accounts in the U.S.

If your customers are enrolled with Zelle® through a financial institution[2], they can send payments directly to your eligible PNC business checking account with just your email address, U.S. mobile phone number, or Zelle® QR Code. With Zelle®, money typically arrives within minutes between enrolled users.

Review the videos on pnc.com/ZelleVideos to learn more about how to use Zelle® safely.

Zelle® Fast Facts

What is Zelle®, and how does it work?

What are the benefits of using Zelle® for business owners?

How to avoid scammers when using Zelle®

How can I help protect my money while using Zelle®?

Zelle® Features

Zelle® Ready Contacts

With Zelle® Ready Contacts, it's easy to see which of your vendors and customers are enrolled with Zelle®.

Zelle® QR Codes

With Zelle® QR codes, it's even easier to receive payments from your customers with Zelle® in the PNC Mobile app.

Zelle® Widgets

What's a Zelle® widget, and why would I want one for my business?

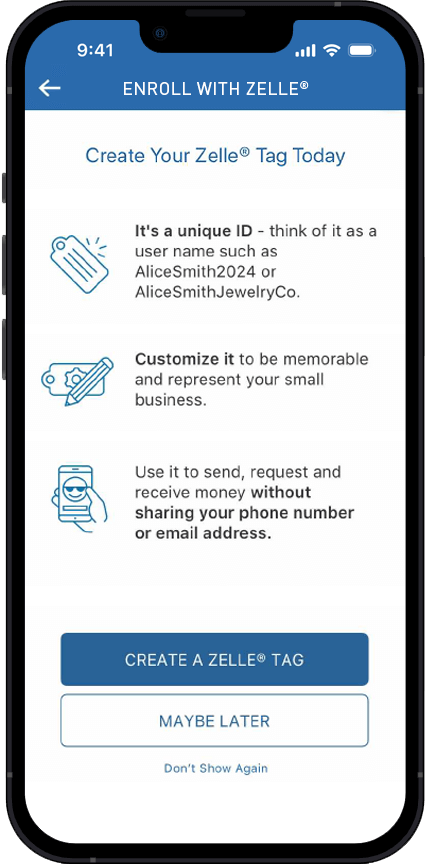

Zelle® Tags

What is a Zelle® tag and how do I use it?

A Zelle® tag is a unique, case-insensitive identifier (like a username) that lets you receive payments via Zelle® without sharing your email address or U.S. mobile number. Your tag must:

- Be at least 6 characters

- Include at least 2 unique letters

- Use no special characters except hyphens

To create one, choose a tag that reflects your business (e.g., abc-company for ABC Company), then go to Zelle® Settings in the PNC Mobile app, tap “Create a Zelle® tag,” and follow the prompts. You can now share your tag to receive payments securely.

To send money to a business, supplier, or vendor enrolled with Zelle®, open the PNC Mobile app, tap “Send,” enter their Zelle® tag, confirm the contact name, enter the amount, and tap “Send.”

Only eligible PNC Business Banking clients can create Zelle® tags, but both business and consumer clients can send money to them.

Eligibility

Who is Eligible?

You may be eligible to use Zelle® for your business if you own a business that provides services to people or other eligible businesses you know and trust[2], such as:

- Landlords collecting rent.

- Health and beauty services: hairstylists, manicurists, massage therapists, estheticians, personal trainers.

- Home care services: landscapers/lawn care providers, tree trimmers, gardeners, snow removal services, pool services, cleaning services.

- Adult and child care providers.

- Therapists: speech, physical, psychologist.

- Lesson providers/coaches: music, tutoring, dance, sports.

- Professional services: photographers, accountants, consultants, financial planners, event planners.

- Pet services: dog walkers, pet sitters.

PNC does not recommend the use of Zelle® for the buying or selling of goods. Neither PNC nor Zelle® offers purchase protection for payments made with Zelle® – for example, if you do not receive the item you paid for, or the item is not as described or as you expected.

Benefits

Benefits to the Business Owner

Faster Access to Funds

- No more delays. Enrolled business customers typically receive payments within minutes, not days.

- No need to worry about returned check deposits or misplaced check or cash payments.

Seamless Experience

- Simply request and receive payments on any day and at any time.

- Zelle® is built into the existing PNC Mobile App, so there’s no need to download another app.

- All transactions are recorded in your bank account activity, which makes reconciliation easy.

Limit Account Detail Sharing

- Reduce exposure of sensitive information by not sharing or requiring bank account numbers.

Request, Receive and Send to Almost Anyone

- As a business, you can manage your accounts payable and accounts receivable with any consumer or business enrolled with Zelle® through their financial institution.

Zelle® is More Convenient Than Cash and Checks

- Enhance cash flow. No need to wait for checks to clear because payments are sent directly to your PNC Business Checking account, typically within minutes[2].

- Money is sent directly to your PNC Business Checking account, so there’s a record of all payments received, and no need to store or transport cash and checks.

- Customers can pay you with Zelle® right from their banking app, so you can receive payments at any time (no extra hardware required) and skip the trip to the bank.

- Receive money by sharing just your email address, U.S. mobile number, or Zelle® QR Code with your customers.

- There are no fees to use Zelle® in the PNC Mobile App.

How It Works

Move Money in the Moment With Zelle®

Download the PNC Mobile App

Open a new account, deposit a check, check balances, make bill payments and more – all from our mobile app on your smartphone or tablet.[1] Available in English and Spanish.

Frequently Asked Questions

Zelle® is a fast, easy, and free[1] way for eligible PNC Business Banking clients to send, request, and receive payments directly between bank accounts in the U.S. If your customers are enrolled with Zelle® through a financial institution, they can send payments directly to your checking account with just your email address, U.S. mobile phone number, or Zelle® QR Code. With Zelle®, payments typically arrive in minutes between enrolled users.[2]

- Zelle® is an easy way to send and receive money with people and businesses you know and trust. Do not use Zelle® to send money to small businesses or people you do not know and trust[2].

- Neither PNC nor Zelle® offers purchase protection for payments made with Zelle® – for example, if you do not receive the item you paid for, or the item is not as described or as you expected.

Zelle® is available to PNC Business Banking customers who have all of the following:

- An eligible PNC business banking checking account

- Business Checking

- Business Checking Plus

- Non-Profit Checking

- Analysis Business Checking

- Analysis Business Checking with Interest

- Treasury Enterprise Plan

- Business Interest Checking

- A PNC Online Banking User ID

- The PNC Mobile app on their Apple or Android mobile device

- An email address and/or a valid U.S. mobile phone number

- As a Business Banking client, you will need to verify that you're the Controlling Party for the business by following the prompts in the PNC Mobile app during Zelle® enrollment.

You can send, receive, and request money with Zelle®[2]. To get started, log in to your PNC Mobile App and select Send Money with Zelle® from the menu. Enter your email address or U.S. mobile number, receive a one-time verification code, enter it, review and accept the Terms of Service, and you are ready to start sending and receiving money with Zelle®.

- To send or receive money with Zelle®, both parties must have an eligible U.S. bank account. For a list of participating financial institutions, visit: zellepay.com/get-started

- If the business or consumer you send money to is already enrolled with Zelle® through their bank’s mobile app, the money is sent directly to their bank account and cannot be canceled. It is important to only send money to people you know and trust, and always ensure you use the correct email address or U.S. mobile number when sending money.

To send or receive money with Zelle®, both parties must have an eligible U.S. bank account. For a list of participating financial institutions, visit: zellepay.com/get-started

Payments between enrolled users are typically received in minutes.[2]

First, you should enroll your email address and/or U.S. mobile number with Zelle® through your PNC Mobile App and link it to your PNC business checking account. Second, share your enrolled email address, U.S. mobile number, or Zelle® QR Code with your customers and ask them to send you payments with Zelle® from their banking app. You do not need to share any sensitive account details; they can send you money by using your enrolled email address or U.S. mobile number to identify you. After the consumer sends you a payment with Zelle®, you will receive the payment directly into your enrolled PNC business checking account.

There are a few ways you can encourage your customers to pay you with Zelle®.

- Tell customers verbally that you accept payments with Zelle®, and that they can easily send you money right from their banking App.

- Include it on an invoice. We recommend adding I accept payments with Zelle® or Pay me with Zelle®.

- Use Zelle® to request money from your customers (which will send them a notification telling them you requested payment with Zelle®).

- Add pre-approved Zelle® content to your business website: zellepay.com/smallbusiness-toolkit

- Display or share your Zelle® QR Code.

To send or receive money with Zelle®, both parties must have an eligible U.S. bank account. For a list of participating financial institutions, visit: zellepay.com/get-started

To request money with Zelle®, select Send Money with Zelle® in your PNC Mobile App, choose Request, select the individual from whom you would like to request money, enter the amount you would like to request, include an optional note, review, and tap on Request. If your customer is not yet enrolled with Zelle®, you can only send a request using their email address.

No, neither PNC nor Zelle® offers purchase protection for payments made with Zelle® – for example, if you do not receive the item you paid for, or the item is not as described or as you expected.

No, PNC does not charge a fee to use Zelle® with a PNC business checking account in the PNC Mobile App[1].

Whether you use Zelle® with a business account or a consumer account, Zelle® uses the same network to initiate payments to businesses and consumers. Consumers who are already enrolled with Zelle® through their mobile banking app do not need to do anything different to send money to a business – they use the existing Zelle® experience they already know and trust within their bank’s mobile app. However, the experience is slightly different for businesses, as businesses cannot currently send payments to or receive payments from consumers who are only enrolled with the Zelle® app (people who use Zelle® with a debit card and are not enrolled with Zelle® through their financial institution).

To get started, log in to your PNC Mobile App. To enroll your PNC business checking account with Zelle®, you must use a different U.S. mobile number or email address than the one you used to enroll your personal checking account with Zelle®.

No, Zelle® does not integrate directly with accounting software at this time. However, since Zelle® is connected to your bank account, you are able to see all Zelle® transactions in your online banking activity. If your bank account transactions feed into your accounting software, you will see the Zelle® payments.

If you own a business that provides services to people or other businesses you know and trust, you are eligible to use Zelle® for your business. We do not recommend using Zelle® for the buying or selling of goods.

Please call us at 877 287-2654 so we can help you.

- You can only cancel a payment if the business or consumer you sent money to has not yet enrolled with Zelle®. To check whether the payment is still pending because the recipient has not yet enrolled, you can go to your Zelle Activity page in the PNC Mobile app, choose the payment you want to cancel, and select Cancel This Payment.

- If you send money to a business or consumer that is already enrolled with Zelle® through their bank’s mobile app, the money is sent directly to their bank account and cannot be canceled. This is why it is important to only send money to people you know and trust, and always ensure you use the correct email address or U.S. mobile number when sending money.

- If you sent money to the wrong person, we recommend contacting the recipient and requesting the money back. If you are unable to get your money back, please call us at 877 287-2654 so we can help you.

While there are no receive limits, your daily and monthly send limits are displayed when sending a payment in the PNC Mobile app.