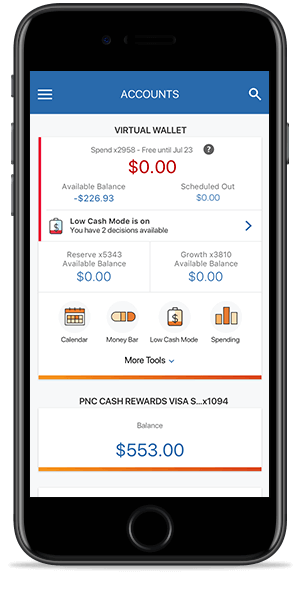

Take control of your account when your balance is low. Low Cash Mode delivers real-time intelligent alerts that let you know when your balance is low, allows you to choose whether certain transactions[8] should be paid or returned, and gives you at least 24 hours to bring your account out of the negative so you can avoid overdraft fees.

- Extra Time – you’ll have at least 24 hours to bring your available account[1] balance to at least $0[9] before you are charged overdraft fees.

- Payment Control – you can choose to pay or return certain individual checks, and payments made using your routing and checking account numbers (ACH transactions),[8] when your balance is negative.

- Intelligent Alerts – a suite of alerts so you know when to and how long you have to take action.

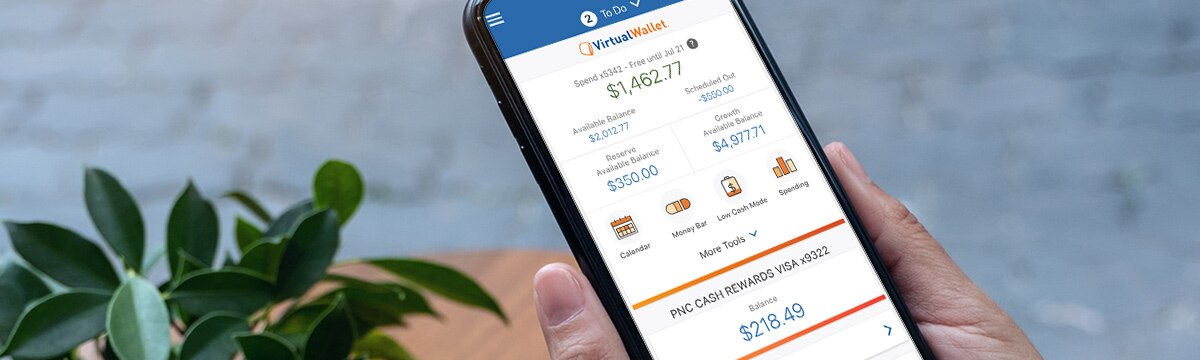

Virtual Wallet's patented digital tools help you to see what's free to spend, stay on track with your budget and reach your financial goals.

Budget and spend wisely

- Calendar shows you upcoming paydays, payments that you've set up and a history of your posted transactions.

- Money Bar® displays the money you've scheduled for bills and what's free to spend.

- Spending & Budgets allows you to group your spending into categories like "Gas" and "Restaurants," create category budgets and set up to receive alerts so you know if you are staying on track.

Know your balance is low

- Danger DaySM appear on your Calendar when your Spend account is at risk of being overdrawn so that you can adjust your spending or move money from savings.

- Alerts can be set up to monitor your accounts for certain activities and you choose how you'd like to receive notifications.

Stick to your plan

- Savings Rules help make saving a little easier with automatic transfers that you set to move money into your Reserve or Growth accounts on a regular basis, like when you receive a paycheck or pay a bill.

- Savings Goals help you save for the things you want and put away money for what you need. Create goals in either or both your Reserve and Growth accounts to save for anything, from a new TV to an upcoming vacation.

It Starts With a Great Checking Account

No minimum balance. No monthly fees. Member FDIC.

Getting started and funding your account is simple and safe.

| Minimum to open | $0 | |

| Minimum balance | $0 | |

| Monthly service charge | $0 | |

| ATM transaction fees |

|

|

| Easily fund your account |

|

Accessing your money is easy to do anytime, anywhere.

- Manage your money through the PNC Mobile app[5] or online banking

- Make purchases with your PNC Bank Visa® Debit Card, or with PNC Pay® on select Android™ devices or other digital payment options

- Deposit checks with the PNC Mobile app[5] or at ATMs

- Transfer money between your PNC accounts or from your external accounts[4]

- Schedule and track bill payments with Online Bill Pay[6]

- Access your money fee-free at nearly 60,000 ATMs across the country, as listed on our ATM locator[3] and get reimbursed for up to $20.00 for other banks' ATM surcharge fees per statement period

- Write unlimited checks

- Send and receive money with people you know and trust in the US using Zelle®[7]

Add Accounts for Planning, Saving and Protection

Bundling checking and savings together creates one powerful solution. Add Reserve & Growth accounts to your Spend, no additional set-up is required.

Set aside money and save more

Reserve is an additional checking account that lets you plan your spending by setting money aside for upcoming events, bills or an unforeseen expense.

Growth is a competitive rate savings account to save for the future and work toward big goals.

Two layers of overdraft protection

Your Spend account automatically comes with Overdraft Protection by linking your Reserve and/or Growth accounts to your Spend account so you can use available funds to cover overdrafts.

Get Ready to Change the Way You Bank

Select the Virtual Wallet that meets your needs.

Virtual Wallet Checking Pro

with Spend, Reserve & Growth

Checking

(In Virtual Wallet, your Checking is called Spend)

- No monthly fees

- $0 minimum deposit to open

- Digital tools to plan and track your spending, including Low Cash Mode[1]

+ Planning, Savings and Protection

(Add Reserve & Growth at no additional cost)

Cash offer

- Earn $200 when you establish total qualifying direct deposit(s) of $2,000 or more to the new Virtual Wallet Checking Pro*

Virtual Wallet Checking Pro

with Spend

Checking

(In Virtual Wallet, your Checking is called Spend)

- No monthly fees

- $0 minimum deposit to open

- Digital tools to plan and track your spending, including Low Cash Mode[1]

Cash offer

- Earn $200 when you establish total qualifying direct deposit(s) of $2,000 or more to the new Virtual Wallet Checking Pro*

We Also Recommend

Is this your home zip code?

PNC product and feature availability varies by location. By using your zip code, we can make sure the information you see is accurate.

If your zip code above is incorrect, please enter your home zip code and select submit.

Important Legal Disclosures and Information

Low Cash Mode is only available on the Spend account of your Virtual Wallet product.

Annual Percentage Yield (APY) accurate as of . The minimum balance to earn interest on your Virtual Wallet Checking Pro Growth account is $1.00. We may refuse or return any deposit amount causing the combined balance of all of your PNC accounts to exceed $5,000,000 (including any jointly owned, or in the case of an account owned by a living trust, jointly managed accounts).

Rates and APYs may vary and may change after account opening. Fees may reduce earnings. Available in eligible markets. Business accounts not eligible.

Visit PNC.com/locator to find a PNC or PNC Partner ATM near you where PNC customers can access money fee-free.

PNC limits the number of transfers that may be made from a savings or money market account without incurring a fee. Please see your account agreement and fee schedule for more information.

PNC does not charge a fee for Mobile Banking. However, third party message and data rates may apply. These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply. Also, a supported mobile device is needed to use the Mobile Banking App. Mobile Deposit is a feature of PNC Mobile Banking. Use of the Mobile Deposit feature requires a supported camera-equipped device and you must download a PNC mobile banking app. Eligible PNC Bank account and PNC Bank Online Banking required. Certain other restrictions apply. See the mobile banking terms and conditions in the PNC Online Banking Service Agreement.

Online bill pay is a free service within PNC Online Banking that is available for residents within the US who have a qualifying checking account. We reserve the right to decline or revoke access to this service. Payments to billers outside of the United States or its territories are prohibited through this service. Tax payments, payments to settle securities transactions, and court ordered payments may be scheduled through the Service; however, such payments are discouraged and must be scheduled at your own risk.

Zelle® should only be used to send or receive money with people you know and trust. Before using Zelle® to send money, you should confirm the recipient's email address or U.S. mobile phone number. Neither PNC nor Zelle® offers a protection program for authorized payments made with Zelle®. Zelle® is available to almost anyone with a bank account in the U.S. Transactions typically occur in minutes between enrolled users. If the recipient has not enrolled, the payment will expire after 14 calendar days. See the PNC Zelle Terms of Use for additional terms and conditions. Use of Zelle® is subject to and conditional upon adherence to the terms and conditions of the PNC Zelle® Terms of Use.

Payment Control applies to certain individual checks, and payments made using your routing and checking account numbers (ACH transactions). Debit card transactions do not qualify for Payment Control. When you choose to return an item that has been presented to PNC for payment, we will return the item to the payee’s bank for insufficient funds, and the payee will not receive payment from PNC. You may still have an obligation to pay the payee for goods, services or other products. PNC is not responsible for satisfying any obligations between you and the payee or any other party with respect to an item you decide to return. Before choosing to return an item, you should consider rules the payee may have or actions the payee may take on late/returned payments. Overdrawing an account, maintaining a negative available balance for any period of time, and returning transactions as unpaid may have other consequences, including account closure or negative impacts to your ability to obtain financial services including loans, deposit accounts, and other services at PNC and other institutions.

In order to avoid overdraft fees, you must bring the available balance in your account to at least $0 before your Extra Time expires. If you make a deposit, the time it takes for your deposit to be reflected in your available balance and for those funds to become available to you will vary based on the deposit type and time. Depending on your deposit type or your deposit time, your deposit may not be available before your Extra Time period expires, and you may incur overdraft fees. See your Funds Availability policy for more information. Overdrawing an account, maintaining a negative available balance for any period of time, and returning transactions as unpaid may have other consequences, including account closure or negative impacts to your ability to obtain financial services including loans, deposit accounts, and other services at PNC and other institutions.

*Offer is contingent on product availability and may vary based on where you open your account and the Zip code of your primary address. For online or phone origination, the Zip code of your primary address will be used to determine product availability. You may earn a $200 reward if you open and use a new Virtual Wallet Checking Pro. If you change your Virtual Wallet product type after account opening, the product type that you are in at the end of the month in which you opened your account will determine your offer eligibility, terms and corresponding reward amount, if applicable.

To qualify for the reward, the new Virtual Wallet product must be opened online via the application links on this page from 07/01/2023 through 08/31/2023, and a qualifying Direct Deposit(s) must be received within the first 60 days. Your Virtual Wallet product must remain open in order for you to receive the reward, which will be credited to the eligible account within 60–90 days after all conditions have been met and will be identified as Credits Check Reward on your monthly statement.

A qualifying Direct Deposit for this offer, is defined as a recurring Direct Deposit of a paycheck, pension, Social Security or other regular monthly income electronically deposited by an employer or an outside agency into the Spend account of a Virtual Wallet Checking Pro. The total amount of all qualifying Direct Deposits credited to your Spend account must be at least $2,000 for Virtual Wallet Checking Pro. Credit card cash advance transfers, wire transfers, person to person transfers, transfers from one account to another or deposits made at a physical PNC location or ATM do not qualify as qualifying Direct Deposits.

New account will not be eligible for offer if you or any signer on the new account has an existing PNC Bank consumer checking account or has closed an account within the past 90 days, or has been paid a PNC promotional premium in the past 24 months. If multiple accounts are opened with the same signers, only one account will be eligible for the premium. Trust, Estate and other specialty titled accounts are excluded from this offer. Offer may be extended, modified or discontinued at any time and may vary by market. The value of the reward may be reported on the appropriate Internal Revenue Service (IRS) forms, and may be considered taxable income to you. Please consult your tax adviser regarding your specific situation.

+Virtual Wallet Checking Pro will no longer be available in the following states as of June 25, 2021: AZ, CA, CO, NM and TX

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Android is a trademark of Google LLC.

Low Cash Mode is a registered mark of The PNC Financial Services Group, Inc.

Virtual Wallet, PNC Pay, and PNC Purchase Payback are registered marks of The PNC Financial Services Group, Inc.

PNC has numerous patents/pending patent applications directed at various features and functions of Virtual Wallet.

Bank deposit products and services provided by PNC Bank, National Association. Member FDIC

Read a summary of privacy rights for California residents which outlines the types of information we collect, and how and why we use that information.