PNC does not charge a fee for Mobile Banking. However, third party message and data rates may apply. These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply. Also, a supported mobile device is needed to use the Mobile Banking App. Mobile Deposit is a feature of PNC Mobile Banking. Use of the Mobile Deposit feature requires a supported camera-equipped device and you must download a PNC mobile banking app. Eligible PNC Bank account and PNC Bank Online Banking required. Certain other restrictions apply. See the mobile banking terms and conditions in the Digital Services Agreement.

Online & Mobile Banking for Business

Do more business banking in less time.

Go Digital When the Time Is Right for You

Mobile Banking

With PNC's Mobile Banking tools, you can monitor your spending, deposit checks, make payments, quickly visualize your monthly net cash flow and more – all from the convenience of your mobile device.

New to Mobile Banking? Download the PNC Mobile App

Mobile Deposits

See how easily Mobile Deposit lets you deposit a check right from your smartphone — quickly and conveniently with mobile deposit and our mobile banking apps — without going to the bank or an ATM.

And with PNC Express Funds, you get the option, for a fee, to make the full amount available immediately for withdrawals and purchases when you deposit an approved check from your mobile phone.

Online Banking & Bill Pay

Enjoy the convenience and efficiency of managing your cash flow whenever and wherever you want. Review account balances and activity, make bill payments, view online statements, view, print or download digital images of paid checks and deposits for up to the past 90 days, order stop payments, or transfer funds between eligible deposit or loan accounts.

Cash Flow Insight®

See and manage your business’s cash flow with an innovative suite of online and mobile tools that provide efficiency, control and insight. Analyze spending through your PNC business checking and Business credit cards by category and month-over-month. Visualize the impact of your actual and projected transactions, manage your short-term forecast, scenario plan and compare your cash position with Cash Flow Insight in Online Banking.

Cash Flow Insight tools in mobile let you keep track of your business’s spending and income month over month. No matter where you are you can see a breakdown of your expenses and income by business category. (Available for both Business Checking and Credit Card accounts)

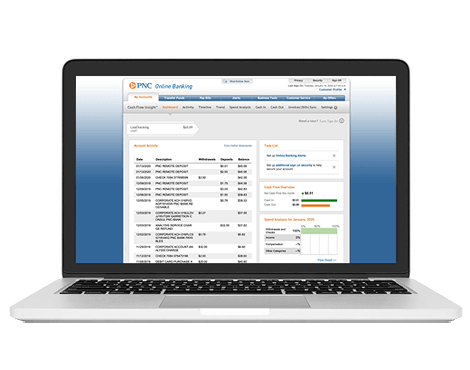

Pay Receive Sync

Manage your finances while helping to protect your business from fraud. PNC’s advanced digital tools for small business allow you, your business partners or designated employees to take care of business finances remotely, 24/7. Take advantage of making payments, paying bills, sending invoices, managing accounting, taking payments online and staying connected with your customers with auto-reminders and online messaging.

PNC Mobile Accept®

A pay-as-you-go payment processing solution designed for startups and small business, making it easy to get paid right from your phone or tablet via the PNC Mobile Banking app. As easy as a dip or swipe – you can also manually enter card information in the PNC Mobile Banking app.

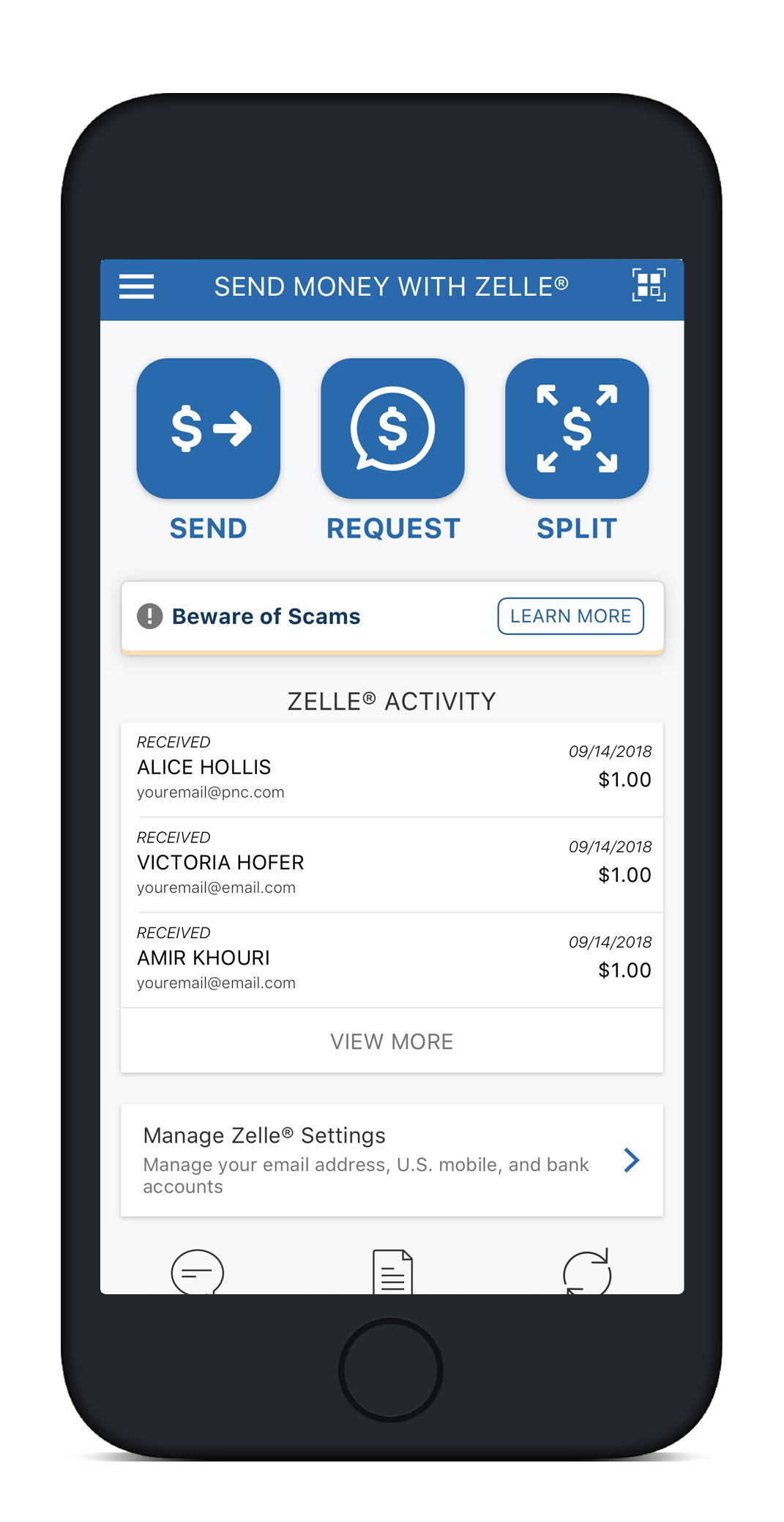

Zelle®[2]

A fast and easy way for eligible businesses to send, receive, and request payments directly between U.S. bank accounts—free in the PNC Mobile app.

If your customers are enrolled with Zelle® through a financial institution, they can send payments directly to your PNC business checking account with just your email address, U.S. mobile phone number, or Zelle® QR Code. With Zelle®, money typically arrives within minutes between enrolled users.

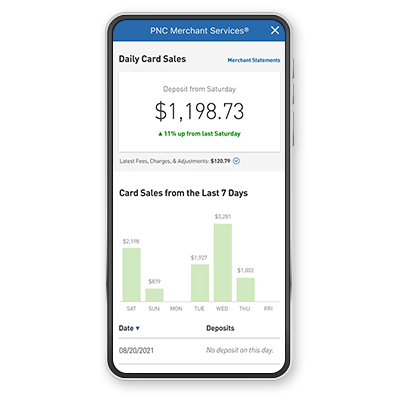

PNC Merchant Services®

Accept card payments with our Merchant Services solutions and use the Daily Card Sales view in your mobile app to check your card sales and compare sales from the last 7 days and access your statements from the last 12 months.

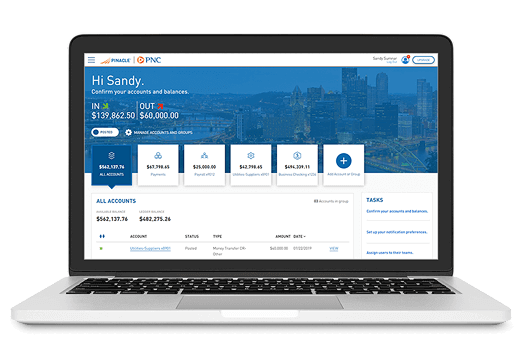

PINACLE® - Built for the way you work

For businesses looking for more robust online features and services PNC delivers PINACLE®, a re-imagined online banking experience built for the way you work.

- Access additional controls and provide secure access to your employees with easy customizable permission capabilities.

- Make payments and help streamline your payment processing with PINACLE Payments, an online payment tool that offers Wire, ACH, Real Time Payments (RTP), and Bill Payments in a single integrated solution.

- Deposit checks electronically through a desktop scanner or your mobile phone and help optimize your deposits and eliminate trips to the bank.

- Enjoy working on your desktop PC or Mac, tablet or mobile device. PINACLE is ready to work wherever you are.

PINACLE® - Additional Services

One-stop access to a variety of PNC's online treasury management services. Whether your goal is to accelerate receivables, manage timing of your payables, or optimize your liquidity position, PINACLE provides quick and easy visibility into your business. With a single sign-on, you can save time and work faster and more productively – directly from your desktop or mobile phone.

Access robust services such as Lockbox, Cash Logistics, Remote Safe, Integrated Payables, BAI Reporting, Liquidity Management, Fraud Protection Services, and more.

We Also Recommend