Online Banking is free to customers with an eligible account; however there may be a fee for certain optional services. We reserve the right to decline or revoke access to Online Banking or any of its services. All online banking services are subject to and conditional upon adherence to the terms and conditions of the Digital Services Agreement.

Your Virtual Wallet® Guide

Get the most out of your banking experience.

Understand Your Virtual Wallet Account

Explore your new account, get set up, and access the tools that await you.

Start with PNC Digital Banking

Start by enrolling in Online Banking. Once you're enrolled, you can also download the PNC Mobile app.

Start Using Your Visa® Debit Card Today

By adding your card to digital wallets with the PNC Mobile app you can start using your Visa Debit Card, even while you wait for it to arrive.

Your physical card will arrive soon via U.S. mail in a plain white envelope.

Get to know your new account features

Start Using Your Visa® Debit Card Instantly

Add your card to your digital wallet with the PNC Mobile app to shop in-store, in-app or online while you wait for your physical card to arrive.

Your physical card will arrive in about 5-7 business days via U.S. mail in a plain white envelope. You will need to activate your physical card when it arrives in the mail.

Add Funds to Your Account

PNC offers multiple ways to add money to your account.

- Direct deposit allows you to electronically deposit your paycheck, pension, Social Security or other regular income from your employer or an outside agency. You can set up your direct deposit in a few easy steps right in the PNC Mobile app. Learn more about how to set up Direct Deposit.

- Deposit a check from your phone using the PNC Mobile app[2]. PNC Express Funds gives you the option, for a fee, to make the full amount available immediately for withdrawals and purchases.[7]

- Deposit checks or cash at a PNC ATM. Find an ATM near you.

- Transfer money from another PNC account or a non-PNC account. Learn more about transferring funds.[8,9]

- Receive domestic incoming wires at no charge if you're a Virtual Wallet Performance Select account holder.

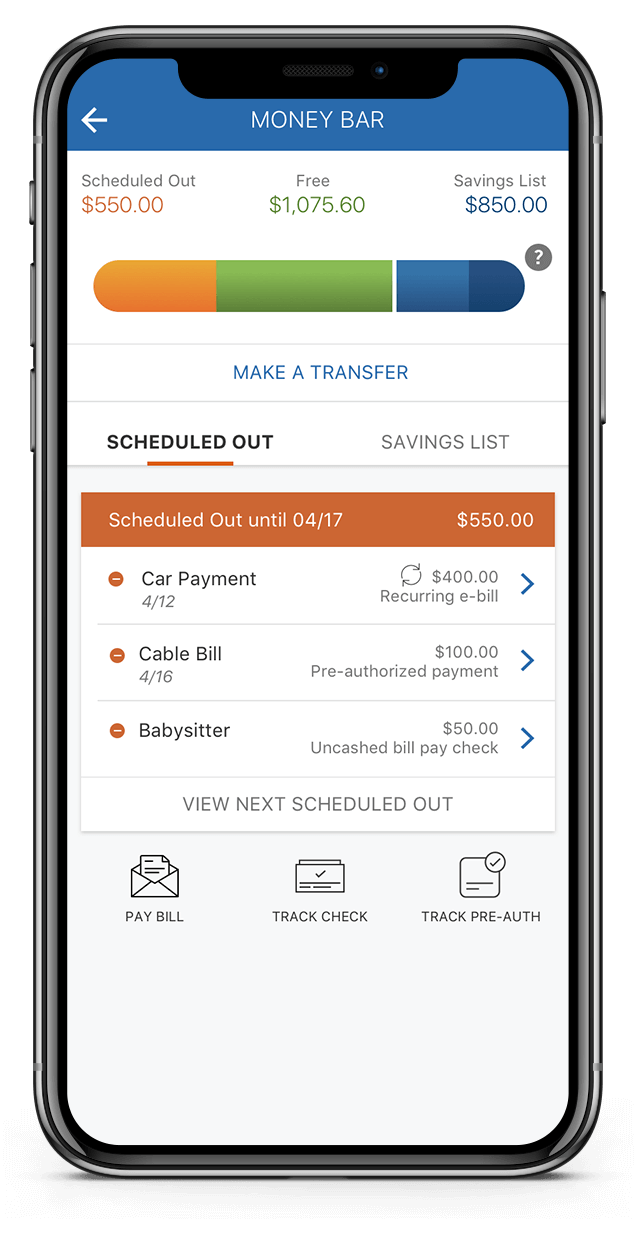

Get to Know Virtual Wallet Tools

Virtual Wallet with Spend, Reserve, and Growth have access to Virtual Wallet savings tools. If you would like to open a Reserve and Growth, visit your local branch to speak to a banker.